Is the AI Bubble Ready to Burst? Valuations, Bets, and Silicon Valley

Introduction

The rapid escalation in the value of AI tech companies has sparked concerns about a potential bubble in Silicon Valley. This fear is reminiscent of past speculative bubbles, such as the dot-com era, where valuations soared only to crash dramatically. The current AI frenzy, driven by massive investments in data centers and advanced chips, has some experts warning of a similar outcome.

Key Details

Companies like OpenAI and Nvidia are at the forefront of this AI boom, with projections suggesting AI spending could reach $1.5 trillion by 2025. However, despite these investments, many AI ventures remain unprofitable, relying heavily on speculative funding. This has led to skepticism about the sustainability of these high valuations, with some predicting a sharp market correction if the bubble were to burst.

Impact

The potential consequences of an AI bubble bursting are significant, given the substantial role AI plays in the current economic landscape. A collapse could have far-reaching effects, impacting not just the tech sector but the broader economy as well. As such, there is growing urgency to assess the true value and potential of AI investments.

About the Organizations Mentioned

OpenAI

OpenAI is a leading artificial intelligence research and deployment company founded in 2015 with the mission to ensure that artificial general intelligence (AGI)—AI systems generally smarter than humans—benefits all of humanity[1][2]. Initially established as a nonprofit, OpenAI’s goal has always been to advance safe and broadly beneficial AI technologies. In 2019, OpenAI created a for-profit subsidiary to scale its research and deployment efforts while keeping mission-aligned governance. As of October 2025, this structure evolved into the OpenAI Foundation (nonprofit) governing the OpenAI Group, a public benefit corporation (PBC). This unique corporate form legally binds OpenAI Group to prioritize its mission alongside commercial success, ensuring broader stakeholder interests are considered[1]. The Foundation holds equity in the Group, aligning incentives for long-term impact and growth. Microsoft owns approximately 27% of OpenAI Group, with employees and investors holding the rest[1]. OpenAI is renowned for pioneering breakthroughs in large language models and AI applications. Its products like ChatGPT revolutionized human-computer interaction by enabling natural language conversations and task automation. OpenAI continuously innovates by integrating AI into business tools—for example, its recent launch of “company knowledge” in ChatGPT Business harnesses AI to aggregate and analyze internal company data from apps like Slack, Google Drive, and GitHub, enhancing workplace productivity and decision-making[3]. Key achievements include advancing AI safety research, reducing hallucinations in language models, and expanding AI’s accessibility through products like Codex and ChatGPT Atlas (a browser with ChatGPT integration)[2]. OpenAI’s balanced governance model and cutting-edge research position it uniquely at the intersection of technology innovation and ethical AI development, making it a focal point in business and technology news globally.

Nvidia

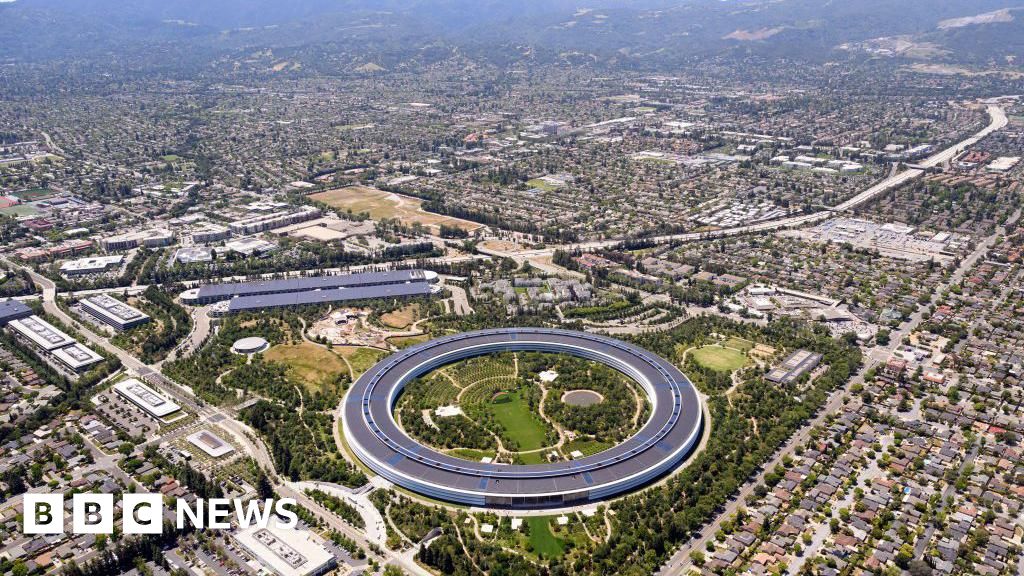

Nvidia Corporation, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem and headquartered in Santa Clara, California, is a pioneering American technology company best known for inventing the graphics processing unit (GPU) in 1999[1][2][4]. Initially focused on GPUs for video gaming, Nvidia has expanded its scope to serve diverse markets, including artificial intelligence (AI), high-performance computing (HPC), professional visualization, automotive technology, and mobile devices[1][3]. Nvidia’s GPUs, such as the GeForce series for gamers and the RTX series for professional applications, are central to its dominance, controlling over 90% of the discrete GPU market as of early 2025[1][4]. The company’s investment in CUDA, a parallel computing platform and API launched in the early 2000s, revolutionized GPU computing by enabling GPUs to accelerate a wide range of compute-intensive tasks, particularly in AI and scientific research[1][4]. By 2025, Nvidia commanded over 80% of the GPU market for AI training and inference and supplied chips to more than 75% of the world’s top 500 supercomputers[1]. Nvidia’s influence extends beyond hardware. It offers a comprehensive ecosystem including software platforms like Omniverse for 3D simulation and digital twins, AI frameworks such as MONAI for medical imaging, and Jetson for robotics and edge AI[2][3]. Its technologies power autonomous vehicle data centers, AI factories, and cloud gaming services like GeForce Now[2][7]. Financially, Nvidia achieved record full-year revenue of $130.5 billion in fiscal 2025, with a workforce of over 36,000 employees worldwide and a robust patent portfolio exceeding 8,700 applications[2]. The company is recognized for innovation and workplace excellence, topping Forbes’ "America’s Best Companies 2025" and Fast Company’s "World’s Most Innovative Companies"