Should You Buy These 7 Stocks After Nvidia's Testing?

Introduction

The stock market is constantly fluctuating, and as investors, it can be challenging to know when to buy or sell. Recently, seven stocks have flashed buy signals after Nvidia's testing, leaving many wondering what they should do. However, with the rise of Affirm and Iren, and the Fed's favorite inflation gauge on tap, there are a few key details that could impact your decision.

Key Details

Affirm and Iren, two fintech companies, have recently seen a surge in their stock prices. This could be due to the increasing popularity of "buy now, pay later" services, as well as the rise of e-commerce during the pandemic. Additionally, the Fed's preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, will be released soon, giving investors a better understanding of the current economic climate and potential future changes in interest rates.

Impact

With these key details in mind, it's important for investors to carefully consider their next moves. Keep an eye on the PCE index and how it may affect the market, as well as the continued growth of fintech companies. As always, it's crucial to do your own research and consult with a financial advisor before making any investment decisions. Remember, the stock market is constantly changing, and it's important to stay informed and adapt accordingly.

About the Organizations Mentioned

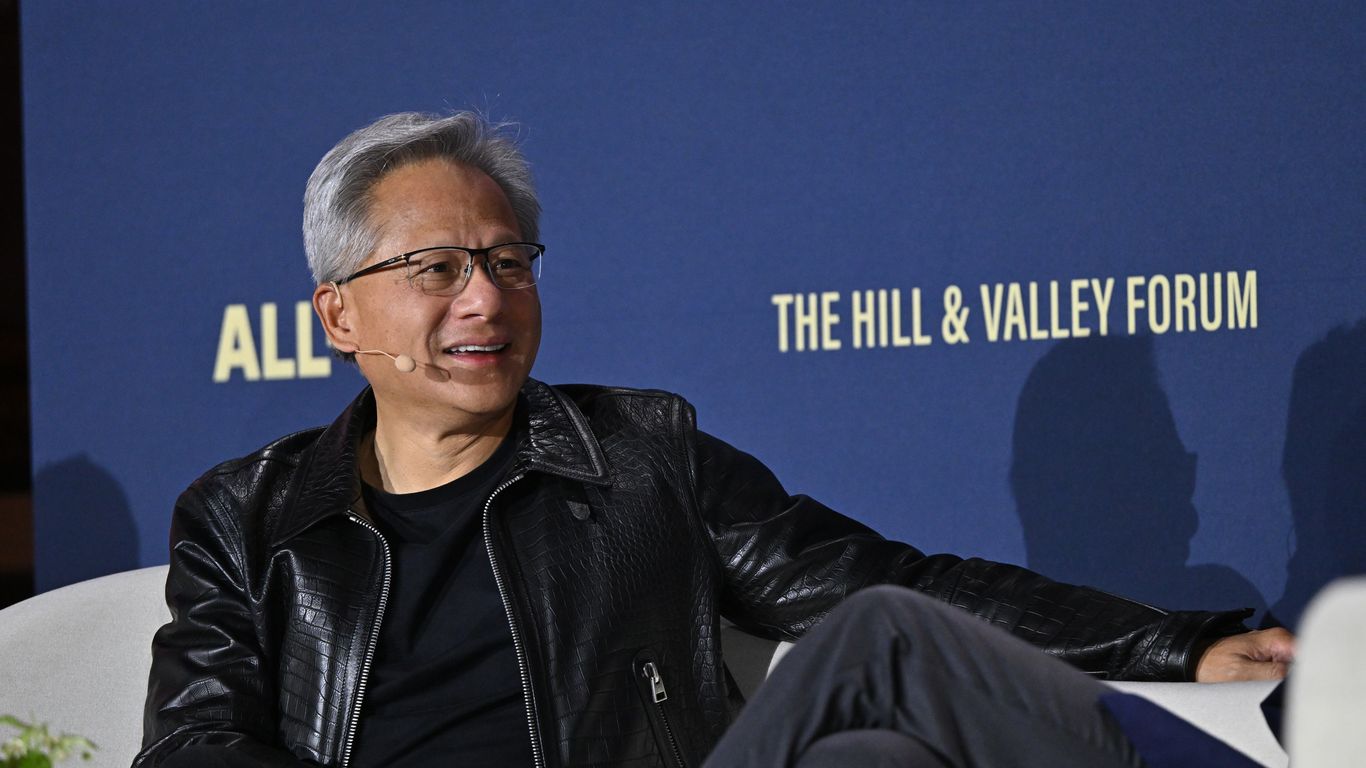

Nvidia

Nvidia Corporation, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem and headquartered in Santa Clara, California, is a pioneering American technology company best known for inventing the graphics processing unit (GPU) in 1999[1][2][4]. Initially focused on GPUs for video gaming, Nvidia has expanded its scope to serve diverse markets, including artificial intelligence (AI), high-performance computing (HPC), professional visualization, automotive technology, and mobile devices[1][3]. Nvidia’s GPUs, such as the GeForce series for gamers and the RTX series for professional applications, are central to its dominance, controlling over 90% of the discrete GPU market as of early 2025[1][4]. The company’s investment in CUDA, a parallel computing platform and API launched in the early 2000s, revolutionized GPU computing by enabling GPUs to accelerate a wide range of compute-intensive tasks, particularly in AI and scientific research[1][4]. By 2025, Nvidia commanded over 80% of the GPU market for AI training and inference and supplied chips to more than 75% of the world’s top 500 supercomputers[1]. Nvidia’s influence extends beyond hardware. It offers a comprehensive ecosystem including software platforms like Omniverse for 3D simulation and digital twins, AI frameworks such as MONAI for medical imaging, and Jetson for robotics and edge AI[2][3]. Its technologies power autonomous vehicle data centers, AI factories, and cloud gaming services like GeForce Now[2][7]. Financially, Nvidia achieved record full-year revenue of $130.5 billion in fiscal 2025, with a workforce of over 36,000 employees worldwide and a robust patent portfolio exceeding 8,700 applications[2]. The company is recognized for innovation and workplace excellence, topping Forbes’ "America’s Best Companies 2025" and Fast Company’s "World’s Most Innovative Companies"

Affirm

**About Affirm** Affirm is a pioneering fintech company that specializes in providing consumers with flexible, transparent financial products, particularly in the "buy now, pay later" (BNPL) space. Founded on the mission to deliver honest financial services that improve lives, Affirm has been committed to making smart financial choices accessible to everyone. **What Affirm Does** Affirm offers consumers the ability to purchase items from various retailers and pay for them over time with no hidden fees, late fees, or compound interest. This approach contrasts with traditional credit card models, aiming to empower consumers by providing clear, upfront terms and flexible payment plans that fit individual budgets[1][3]. By partnering with businesses, Affirm facilitates financing solutions that enhance consumer purchasing power. **History and Achievements** While specific details about Affirm's founding date are not provided in the available information, the company has achieved significant milestones. Notably, Affirm has processed a substantial gross merchandise volume, emphasizing its growing influence in the BNPL market[1]. The company's commitment to transparency and consumer-friendly practices has garnered positive reviews from users, highlighting its user-friendly payment plans and lack of hidden charges[3]. **Current Status** Affirm is a publicly-traded company, indicating its successful transition to a major player in the fintech industry. It operates as a remote-first employer, emphasizing diversity, equity, and inclusion (DEI) in its organizational culture[2]. This approach reflects Affirm's commitment to innovation and employee well-being. **Notable Aspects** - **Mission-Driven Approach**: Affirm prioritizes consumer welfare, focusing on honest financial products that avoid profiting from mistakes or misfortune[1]. - **Innovative Payment Solutions**: By offering no late fees or surprises, Affirm provides a refreshing alternative to traditional credit products[3]. - **Cultural Emphasis**: Its remote-first model and emphasis on DEI make it an attractive employer in the tech industry[2].

Iren

Iren is a leading Italian multi-utility company specializing in the integrated management of energy, water, and environmental services. Founded in 2010 through the merger of several regional utilities, including AMGA, Iride, and Enìa, Iren has grown to become a key player in Italy’s sustainable development and smart city initiatives. The company operates across a broad spectrum of sectors, including electricity and gas distribution, district heating, water treatment, waste management, and renewable energy production, positioning itself at the forefront of the transition to a low-carbon economy. From its inception, Iren has focused on innovation and sustainability, investing heavily in cutting-edge technologies such as smart grids, advanced metering infrastructure, and energy efficiency solutions. This approach has enabled the company to optimize resource management and reduce environmental impact, aligning with European Union climate goals. Its integrated model allows Iren to deliver comprehensive utility services to over 4 million citizens across multiple Italian regions, making it one of the largest multi-utility operators in the country. Key achievements include the expansion of renewable energy capacity, particularly in hydroelectric, solar, and biomass power plants, contributing significantly to Italy’s green energy targets. Iren’s commitment to circular economy principles is evident in its waste-to-energy plants and extensive recycling programs, which have set benchmarks in environmental stewardship. The company is also known for its digital transformation efforts, leveraging data analytics and IoT to enhance operational efficiency and customer experience. Currently, Iren continues to pursue growth through strategic acquisitions and partnerships, while maintaining a strong focus on innovation, sustainability, and social responsibility. Its integrated business model and technological advancements make it a compelling example of how traditional utilities can evolve to meet the challenges of the 21st century, blending business success with environmental and social value creation.

Fed

The **Federal Reserve System (Fed)** is the central bank of the United States, created by Congress in 1913 to provide a safer, more flexible, and stable monetary and financial system[1][2]. It consists of a Board of Governors in Washington, D.C., and 12 regional Reserve Banks located across the country, each serving distinct districts, collectively overseeing national monetary policy, financial supervision, and payment services[1]. The Fed’s core responsibilities include **conducting monetary policy**, **regulating and supervising banks**, and **maintaining an effective payments system**[1][3]. Its most visible function is managing monetary policy to influence money supply and credit with the goals of **price stability** and **maximum sustainable employment**, a dual mandate established by legislation in the 1970s[3]. To achieve this, the Federal Open Market Committee (FOMC) targets the federal funds rate, guiding interest rates and liquidity through tools like open market operations and reserve requirements[3]. Historically, the Fed was established after two previous central banks failed in the 19th century, responding to early 20th-century financial turbulence with a hybrid federal-regional system designed to balance centralized control and local insight[2]. The Federal Reserve’s decentralized structure allows it to closely monitor economic conditions nationwide and respond to regional challenges[2]. Key achievements include successfully navigating multiple financial crises by ensuring liquidity and financial stability, and continuously evolving its monetary policy framework. The Fed conducts a comprehensive review of its monetary strategy every five years, with the latest in 2025 incorporating public feedback and academic research to refine its approach to stabilizing the economy[4][7][9]. The 2025 update reaffirmed commitment to its dual mandate, emphasizing transparency and adaptability[5]. Currently, the Fed is managing the transition from pandemic-era monetary expansions by shrinking its balance sheet to maintain adequate liquidity while continuing to influence interest rates effectively within an ample reserves framework[6]. Its independence and nonpartisa