Fed Decision and its Impact on Investors

Introduction

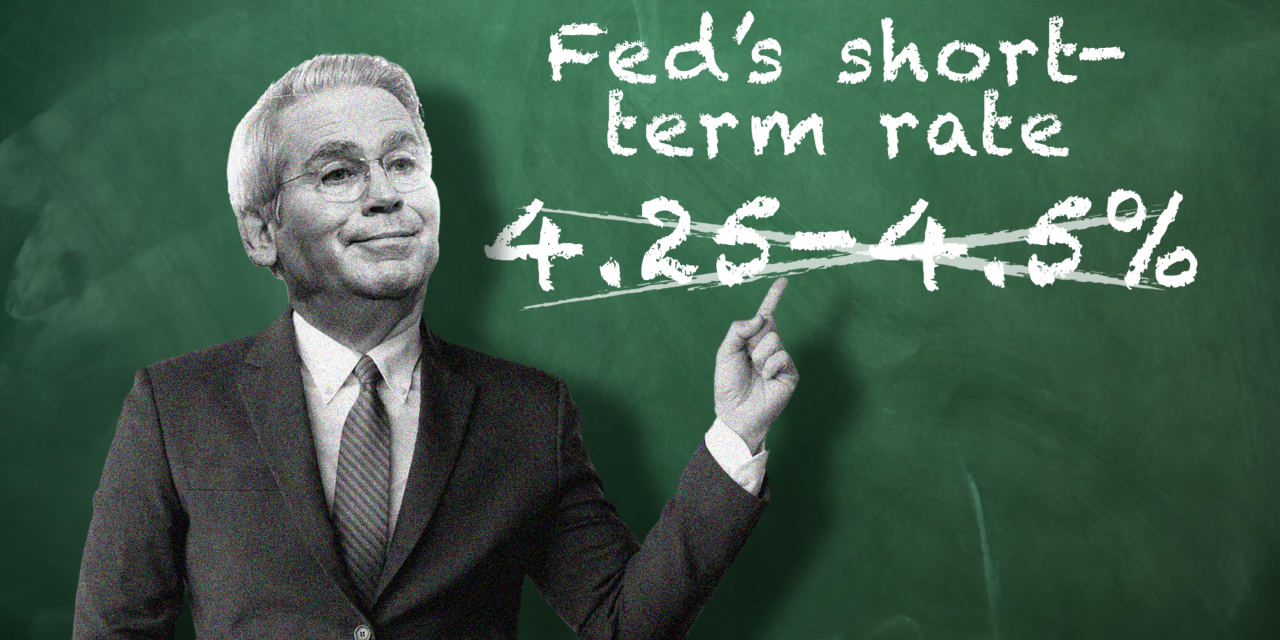

The upcoming week is set to be a crucial one for investors, as they eagerly anticipate the Federal Reserve's decision on whether to push back against market bets for a series of interest-rate cuts extending into next year. The question at hand is whether the Fed officials will continue to support bullish bets, which have been driving the markets in recent weeks.

Key Details

The expectations for multiple rate cuts have been fueled by the ongoing trade tensions between the US and China, as well as global economic slowdown concerns. However, some analysts argue that a series of cuts may not be necessary, as the US economy still shows strength in terms of low unemployment rates and steady consumer spending. At the same time, others warn that if the Fed does not deliver on market expectations, it could lead to a significant market correction.

Impact

The Fed's decision will not only impact the stock market, but also other asset classes such as bonds and currencies. Additionally, it will have significant implications for businesses and consumers, as interest rates can affect borrowing costs and ultimately influence spending and investment decisions. Investors will be closely watching the Fed's language and any hints towards future policy actions.