Gold Prices Could Soar with Potential Federal Reserve Undermining by Trump

Introduction

According to analysts at Goldman Sachs, the price of gold could reach nearly $5,000 if President Trump continues to undermine the Federal Reserve. This prediction comes after Trump's recent attacks on the US central bank, which have caused concern about the dollar's status as a reserve currency and have led to a rally in the price of precious metals.

Key Details

The dollar's reserve status is crucial for the US economy, as it allows the country to maintain low interest rates and borrow at cheaper rates. However, the recent comments from the President have raised doubts about the stability of the dollar, leading investors to turn to alternative assets such as gold. This has caused the precious metal's price to surge, with an increase of more than 13% since the beginning of the year.

Impact

If the dollar's reserve status is compromised, it could have a significant impact on the global financial system. The US would face higher borrowing costs, and the value of the dollar could decrease, making imports more expensive. On the other hand, gold would become an attractive investment, with its value likely to rise even further. This could also have implications for other currencies and commodities, as investors look for safe-haven assets in times of uncertainty.

About the People Mentioned

President Trump

Donald John Trump, born June 14, 1946, in Queens, New York, is an American businessman, media personality, and politician who has served as the 45th and 47th president of the United States. He graduated from the University of Pennsylvania's Wharton School with a degree in economics in 1968 and took over his family’s real estate business in 1971, renaming it the Trump Organization. Over decades, he expanded the company’s holdings into skyscrapers, hotels, casinos, and golf courses, building a high-profile brand often associated with luxury and real estate development. Trump also gained fame as the host of the reality TV show *The Apprentice* from 2004 to 2015[1][3][7]. Trump entered politics as a Republican and won the presidency in 2016, defeating Democrat Hillary Clinton in an unexpected victory. His tenure from 2017 to 2021 was marked by significant policy shifts, including tightening immigration controls, imposing a travel ban on several Muslim-majority countries, expanding the U.S.–Mexico border wall, rolling back environmental regulations, implementing major tax cuts, and appointing three Supreme Court justices. His foreign policy included withdrawing the U.S. from international agreements on climate change and Iran’s nuclear program, and initiating a trade war with China. Trump's handling of the COVID-19 pandemic was widely criticized for downplaying the virus's severity. After losing the 2020 election to Joe Biden, he challenged the results, culminating in the January 6, 2021, Capitol attack. Trump was impeached twice but acquitted both times by the Senate[1][2]. In a historic political comeback, Trump was re-elected and inaugurated for a second non-consecutive term on January 20, 2025, becoming the oldest president to assume office at age 78. He remains a highly influential and polarizing figure in American politics[2][7]. Trump is married to Melania Trump, with whom he has one son, Barron, and has four adult children from previous marriages. He has authored several books, including *The Art of the Deal*, a business bestseller[3][5][7].

About the Organizations Mentioned

Goldman Sachs

**Goldman Sachs: A Global Financial Leader** Goldman Sachs is a renowned global financial institution, celebrated for its investment banking prowess, wealth management, and capital markets expertise. Founded over 150 years ago, the firm has navigated economic cycles, regulatory shifts, and technological advancements to maintain its elite position. **History and Evolution** Initially a commercial paper broker, Goldman Sachs transitioned from a private partnership to a public company in 1999, enhancing its capital base. The firm converted into a bank holding company in 2008 to access emergency funding during the financial crisis. In recent years, Goldman Sachs has expanded its consumer banking arm through initiatives like "Marcus" and strengthened its asset management division. In 2023, it restructured into three core divisions: **Global Banking & Markets**, **Asset & Wealth Management**, and **Platform Solutions**. **Key Achievements and Current Status** - **Global Reach**: Goldman Sachs operates in over 40 countries, with a significant presence in the Americas, Europe, Middle East & Africa (EMEA), and Asia. As of 2024, it had a headcount of 46,500 employees[2]. - **Financial Performance**: The firm continues to demonstrate robust financial performance, with a diversified business model that includes strategic advisory services, trading, lending, and investment management[1][3]. - **Innovation and Adaptation**: Goldman Sachs remains at the forefront of financial innovation, leveraging technology to enhance its services and adapt to evolving market trends. **Notable Aspects** - **Investment Insights**: The firm publishes influential reports, such as the Family Office Investment Insights, which highlight trends in global investment strategies[4]. - **Market Outlook**: Goldman Sachs provides comprehensive market analysis, predicting future economic cycles and advising on investment strategies[6]. - **Commitment to Community**: The firm supports community development through grants and internships, fostering a culture of excellence and social responsibility[5].

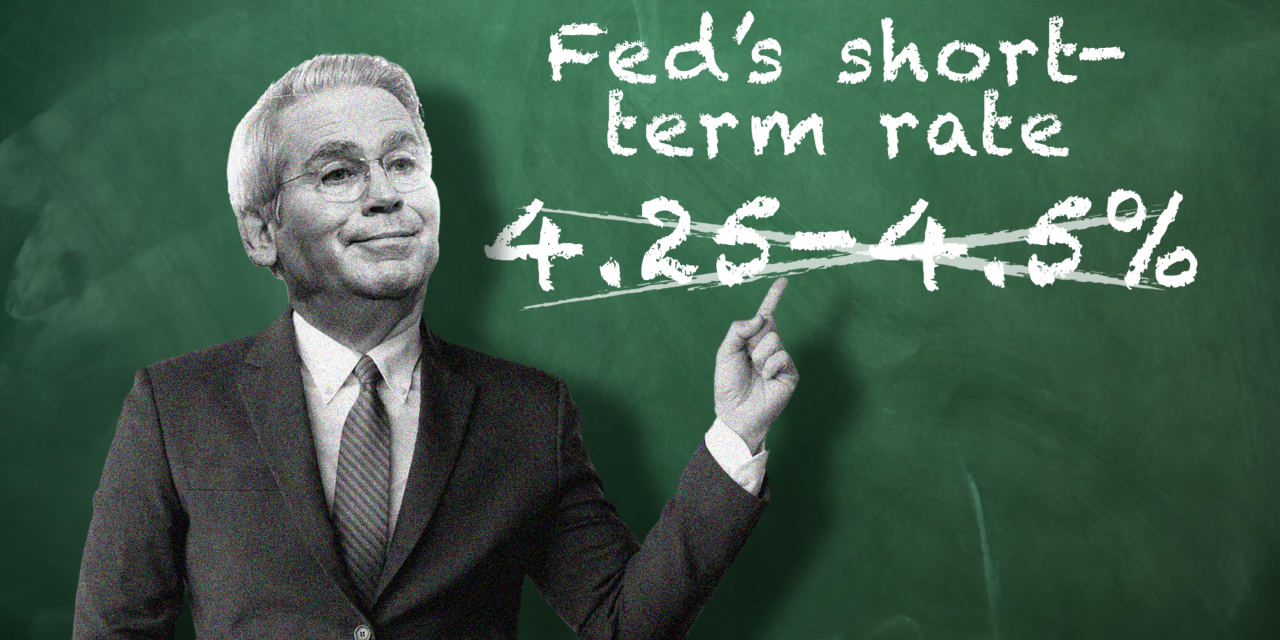

Federal Reserve

## Overview and Mission The Federal Reserve, often called the "Fed," is the central bank of the United States, established by Congress in 1913 to provide the nation with a safer, more flexible, and stable monetary and financial system[1]. Its mission centers on a dual mandate from Congress: to promote maximum employment and maintain price stability, ensuring the dollar retains its value over time[1]. The Fed operates through a unique hybrid structure, combining a national Board of Governors in Washington, D.C., with 12 independent regional Reserve Banks, including institutions like the Cleveland Fed[1]. This decentralized setup allows the Fed to closely monitor economic conditions across diverse regions, industries, and communities, while maintaining independence from short-term political influences[1]. ## Key Functions The Fed’s responsibilities are broad and vital to the U.S. economy. It conducts monetary policy—primarily by influencing interest rates—to achieve its employment and inflation goals[2]. The Fed also supervises and regulates banks to ensure the safety and soundness of the financial system, works to minimize systemic risks, and fosters efficient payment and settlement systems[2]. Additionally, it promotes consumer protection and community development, addressing emerging issues through research, supervision, and enforcement of consumer laws[2]. ## History and Evolution The Federal Reserve is the third central bank in U.S. history, following two failed attempts in the 19th century[1]. Its creation was a response to the financial turbulence of the early 20th century, aiming to prevent crises and stabilize the economy. Over time, the Fed has evolved, adopting more transparent and inclusive policymaking processes. For example, it now conducts regular reviews of its monetary policy framework, engaging with academics, businesses, and the public to refine its strategies and communications[3][5]. ## Recent Developments and Achievements In 2025, the Fed completed its second major review of its monetary policy strategy, tools, and communications, reaffirming its commitment to transparenc