The Return of Meme Stocks: How Social Media is Shaping the Stock Market

Introduction

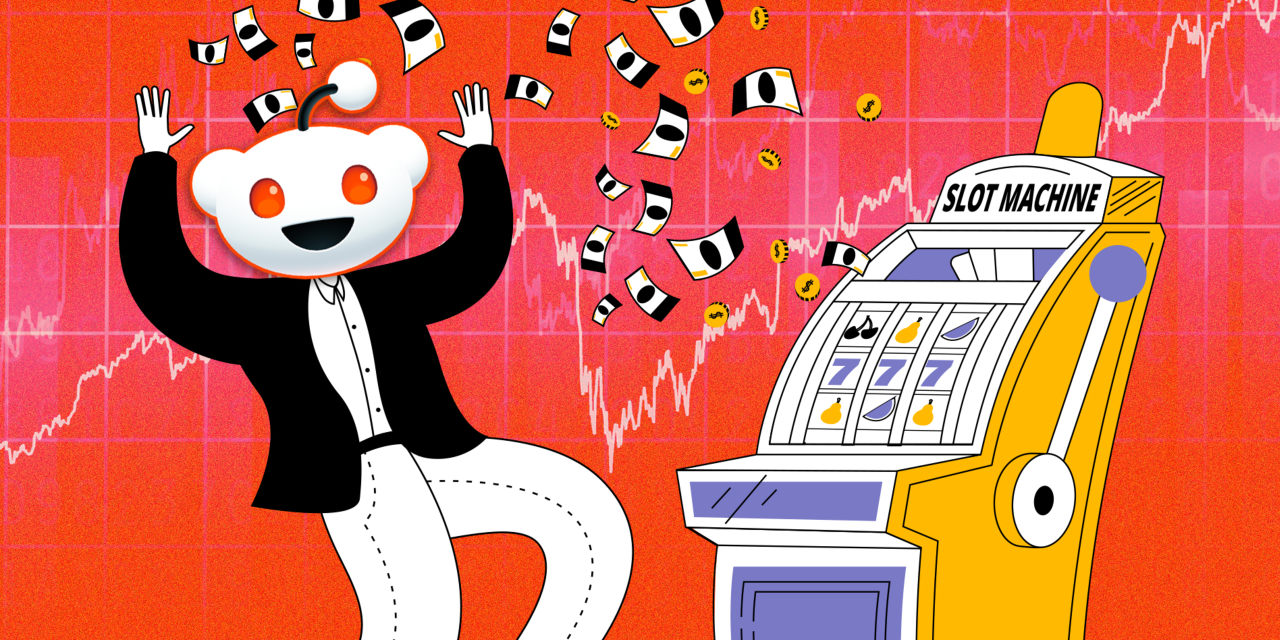

The meme-stock mania is back, and Reddit traders are once again boasting about their wins. In just about an hour, some traders have already made a profit of $45,000, with companies like Krispy Kreme and GoPro joining the rise in meme stocks. This latest rally also includes Opendoor and Kohl's, but traders have had to move quickly to lock in their gains.

Key Details

This resurgence of meme stocks is fueled by the power of social media and online communities. Retail investors on Reddit's WallStreetBets forum are sharing their strategies and encouraging others to jump on the bandwagon. As a result, these stocks are experiencing a surge in demand, leading to significant gains for some traders. However, it's important to note that this type of trading is highly speculative and can be risky for inexperienced investors. It's crucial to do thorough research and consult with financial experts before making any investments.

Impact

The return of meme stocks has once again brought attention to the power of online communities and the influence they have on the stock market. It also highlights the potential risks of following the crowd and making impulsive investment decisions. While it may be tempting to join in on the hype and try to make a quick profit, it's important to approach trading with caution and not get caught up in the excitement. As with any investment

About the Organizations Mentioned

Reddit is a leading American social news aggregation, discussion, and forum platform where registered users submit content such as links, text posts, and images, which are then voted up or down by other users. Founded in 2005, Reddit has evolved into a vast network of communities dedicated to virtually every topic imaginable, fostering engagement through user-driven content and conversations. Its mission centers on empowering diverse communities and making their collective knowledge accessible to everyone[1][2]. Initially owned by Condé Nast, Reddit became an independent company while Advance Publications, Condé Nast's parent, retained majority ownership. Headquartered in San Francisco, Reddit has expanded significantly, doubling its workforce in 2017 to approximately 350 employees by 2018. Key leadership includes co-founder and CEO Steve Huffman, CTO Chris Slowe, and COO Jen Wong, reflecting a blend of technical and media expertise[1]. Reddit's influence extends beyond typical social media, exemplified by the 2021 GameStop short squeeze, which was largely organized on its r/wallstreetbets subreddit, illustrating the platform’s unique power in shaping real-world financial events. The company also experimented with blockchain technology through site-specific cryptocurrencies like Reddit Moons, though these faced regulatory and scalability challenges leading to their discontinuation in late 2023[1]. Financially, Reddit has demonstrated robust growth. As of Q2 2025, it reported $500 million in revenue, up 78% year-over-year, with net income of $89 million. Its user base is enormous and growing, with 110.4 million daily active users and 416.4 million weekly active users as of mid-2025, underscoring its position as one of the most vibrant and engaged online communities worldwide[3][2]. Notably, Reddit maintains a distinct corporate culture with transparent salary policies and generous parental leave, emphasizing employee well-being alongside innovation. Its blend of community-driven content, technological experimentation, and strong financial performance makes Reddi

Krispy Kreme

## Overview Krispy Kreme is an iconic American multinational doughnut company and coffeehouse chain, renowned worldwide for its signature Original Glazed doughnut and its “Hot Doughnuts Now” experience[6][8]. The company’s mission is to deliver joy through high-quality, innovative doughnuts, leveraging both traditional craftsmanship and modern technology to maintain consistency and freshness[8]. ## History Krispy Kreme was founded by Vernon Rudolph in Winston-Salem, North Carolina, on July 13, 1937[3][5]. Rudolph’s journey began when he acquired a secret yeast-raised doughnut recipe and the rights to the Krispy Kreme name from a New Orleans chef[2][6]. Initially selling to local grocery stores, demand from passersby led Rudolph to open a retail window—literally cutting a hole in the building’s wall—to sell doughnuts directly to customers[4][5]. This marked the birth of the brand’s retail tradition and cult following. Throughout the 1940s and 1950s, Krispy Kreme standardized its operations by centralizing mix production and developing proprietary doughnut-making equipment, ensuring product consistency as the chain expanded across the Southeast[2][5]. By the late 1950s, there were 29 shops in 12 states[1]. After Rudolph’s death in 1973, the company changed hands several times, including a period under Beatrice Foods (1976–1982) and a leveraged buyout by franchisees in 1982[1][2]. Krispy Kreme went public in 2000, expanded aggressively, but faced financial challenges in the mid-2000s, leading to a return to private ownership in 2016 under JAB Holding Company[6]. The company went public again in 2021, reflecting renewed investor confidence[6]. ## Key Achievements - **Product Innovation:** Krispy Kreme’s Original Gl

GoPro

GoPro is an American technology company founded in 2002 by Nick Woodman, initially named Woodman Labs, Inc., and headquartered in San Mateo, California[2][4]. It specializes in manufacturing compact, durable action cameras designed to capture high-quality photos and videos in extreme conditions, especially for sports, adventure, and outdoor enthusiasts. The company also develops mobile apps and video-editing software, enhancing the user experience in content creation and sharing[2]. The origin of GoPro traces back to Woodman’s personal need as a surfer to document his and his friends’ surfing moments more intimately than traditional cameras allowed. In 2004, GoPro released its first product—a wrist-mounted 35mm film camera—ushering in a new era of action photography by enabling users to capture immersive, first-person perspectives[1][3]. This innovative concept quickly grew in popularity, even though the early cameras were not technically superior; the lifestyle and experience they offered resonated widely with consumers[3]. GoPro expanded its product line with digital cameras, notably the HERO series, which became the industry standard for action sports videography. The company achieved rapid growth, becoming America’s fastest-growing company by 2012 and reaching a significant market share in digital camcorders[3]. It went public in 2014, listing on NASDAQ under the ticker “GPRO”[4]. Despite some setbacks, such as the short-lived Karma drone released in 2016 and discontinued two years later, GoPro has maintained its position as a leader in the action camera market. The company is known for its partnerships with prominent athletes like Kelly Slater and Jimmy Chin, leveraging authentic endorsements to strengthen its brand[2]. GoPro also innovated with products like the Omni rig for 360° VR video creation[2]. Today, GoPro remains a beloved global brand, recognized for transforming how people capture and share their active lifestyles, blending technology, adventure, and storytelling into a unique consumer experience

Opendoor

Opendoor is a technology-driven real estate company that has redefined the traditional home selling and buying process through its innovative “iBuying” (instant buying) business model[7]. The company’s core offering allows homeowners to receive instant, all-cash offers for their properties, often within days, bypassing the lengthy and uncertain conventional real estate process[2][4]. Opendoor uses proprietary algorithms, artificial intelligence, and data analytics to assess property values, make offers, and manage transactions entirely online, providing a streamlined, digital-first experience for its customers[1]. ## History and Founding Opendoor was founded in March 2014 by Keith Rabois, Eric Wu, and JD Ross, with the vision of making real estate transactions faster, simpler, and less stressful[1]. The inspiration for the company stemmed from the founders’ desire to eliminate the complexities and delays associated with traditional home sales. By 2016, Opendoor had launched a trade-in service, enabling customers to sell their current home and purchase a new one in a single, seamless transaction[1]. The company quickly scaled its operations, leveraging significant venture capital to expand into multiple U.S. markets. ## Key Achievements Opendoor rapidly became a leader in the iBuying space, outpacing established competitors like Zillow and Redfin in terms of transaction volume and revenue growth[6]. At its peak, Opendoor’s projected revenue for 2021 was $7.2 billion, with healthy profit margins, demonstrating both the scalability and profitability of its model[6]. The company’s technology platform not only delivers instant offers but also handles property repairs, staging, and resale, creating a turnkey solution for sellers[4]. Opendoor’s offer acceptance rate exceeds 50%, reflecting strong consumer demand for its hassle-free selling process[2]. ## Current Status and Notable Aspects As of late 2025, Opendoor continues to expand

Kohl's

Kohl's Corporation is a major American department store retail chain with over 1,165 locations across 49 U.S. states, excluding Hawaii. Founded in 1927 by Polish immigrant Maxwell Kohl in Milwaukee, Wisconsin, the company evolved from a single grocery store to a department store chain by 1962. Ownership changed hands multiple times, including British American Tobacco's control in 1972 and a public offering in 1992. Headquartered in Menomonee Falls, Wisconsin, Kohl's became the largest U.S. department store chain in 2012, surpassing JCPenney, and ranked as the 23rd-largest U.S. retailer by revenue in 2019[1]. Kohl’s operates as a leading omnichannel retailer, integrating physical stores, its website, and mobile app to serve over 60 million customers. It focuses on delivering great products, value, and customer experience, aiming to support families’ real-life moments. Kohl’s reported total revenues exceeding $16 billion, operating more than 1,100 stores and contributing over $875 million to communities. Despite recent challenges reflected in a 4-5% year-over-year decline in net sales during early and mid-2025, the company emphasizes its commitment to long-term shareholder value through a curated product assortment and enhancing its omnichannel capabilities[2][3][4][5]. Leadership has recently experienced turnover, with Michael Bender as Acting CEO as of May 2025, following the brief tenure of Ashley Buchanan and predecessor Tom Kingsbury. Kohl’s continues to adapt strategically to retail market pressures by focusing on value, quality, and seamless customer experiences both online and in-store[1][5]. Notably, Kohl’s success lies in balancing tradition with innovation, leveraging its extensive footprint and technological platforms to maintain relevance in a competitive retail landscape. The company’s integration of technology and community engagement highlights its evolving role as a retailer committed to customer convenience and social impac

WallStreetBets

## WallStreetBets: A Community of Retail Traders **Overview and History** WallStreetBets (WSB) is a subreddit founded by Jaime Rogozinski on January 31, 2012. Initially, it was created as a platform for discussing high-risk trades and making short-term gains with disposable income[1][2]. The community grew slowly, reaching about 100,000 subscribers by 2017[2]. Over time, WSB became a hub for retail traders to share trade ideas and research, often embracing a "YOLO" (You Only Live Once) culture of risky investments[3][6]. **Key Achievements and Notable Aspects** WSB gained international attention for its role in the GameStop stock surge in early 2021. Members collectively bought GameStop shares to counter hedge funds that had heavily shorted the stock, viewing it as a form of resistance against financial institutions[5][6]. This event highlighted WSB's ability to influence market dynamics and challenge traditional Wall Street players. Notable figures like Martin Shkreli, Mark Cuban, and Elon Musk have interacted with the community[1]. Despite its often controversial nature, WSB has become a significant force in retail trading, leveraging platforms like Robinhood and WeBull[2]. **Current Status** As of 2022, WSB had over 13.3 million subscribers, making it one of the most active subreddits[1]. The community continues to evolve, with a strong focus on options trading and a vibrant culture of self-referential humor and risk-taking[7]. **Challenges and Controversies** Jaime Rogozinski was removed as a moderator in 2020 after attempting to trademark the subreddit's name, leading to a lawsuit against Reddit that was dismissed in 2023[1]. Despite these challenges, WSB remains a powerful symbol of retail traders' influence on financial markets.