The Republican Divide over the Trump Tax Bill

Introduction

The Trump Tax Bill is causing a stir in the Senate, with Republican senators torn by competing demands. Senate Majority Leader John Thune is rushing to meet President Donald Trump’s deadline of July 4 to push through his massive tax and spending bill. However, he first has to work through a list of approximately eight Republican senators who have expressed opposition to the bill.

Background

President Trump has been pushing for a tax bill to be on his desk by July 4 since his return from an overseas trip. The bill aims to provide tax cuts for both individuals and corporations, as well as make significant changes to the current tax system. However, the bill has faced numerous challenges and hurdles since its introduction.

Current Scenario

Despite the President’s efforts, the bill is still facing opposition from within the Republican party. In fact, some are skeptical of the July 4 deadline and are pushing for more time to deliberate and make changes to the bill. This is causing a divide within the party, with some senators expressing concerns about the potential impact on the national debt and others pushing for more tax cuts for the middle class.

While the bill has been a major focus for the Trump administration, it has faced criticism from both sides of the political spectrum. Some experts have expressed concerns that the bill could put the GOP in a bind, with its potential impact on the national debt and the flippant defenses of Trump’s agenda. Additionally, the bill has also faced scrutiny for its resemblance to the President’s own policies and priorities, with “MAGA accounts” and more.

As the bill continues to face opposition and challenges in the Senate, it remains to be seen if it will meet the July 4 deadline. In the meantime, President Trump is continuing his Middle East trip, meeting with various leaders and addressing issues in the region. However, his decision to bypass Israel has raised questions about a possible rift with Prime Minister Netanyahu.

Conclusion

The Trump Tax Bill has been a major focus for the Trump administration, with the President pushing for its passage by July 4. However, the bill is facing opposition and challenges from within the Republican party, causing a divide and raising questions about its potential impact on the national debt. As the President continues his trip in the Middle East, it remains to be seen if the bill will meet its deadline and how it will ultimately affect the economy and the American people.

About the People Mentioned

Donald Trump

Donald John Trump, born June 14, 1946, in Queens, New York, is an American businessman, media personality, and politician. He graduated from the University of Pennsylvania’s Wharton School in 1968 with a degree in economics. In 1971, he took over his family’s real estate business, renaming it the Trump Organization, through which he expanded into building and managing skyscrapers, hotels, casinos, and golf courses. Trump gained widespread fame as the host of the reality TV show *The Apprentice* from 2004 to 2015, which helped establish his public persona as a successful entrepreneur. Trump entered politics as a Republican and was elected the 45th president of the United States, serving from 2017 to 2021. His presidency was marked by significant policy actions including tax cuts, deregulation, the appointment of three Supreme Court justices, renegotiation of trade agreements (notably replacing NAFTA with the USMCA), and a focus on immigration control including border wall expansion. He withdrew the U.S. from international agreements such as the Paris Climate Accord and the Iran nuclear deal, and engaged in a trade war with China. His administration’s response to the COVID-19 pandemic was criticized for downplaying the virus’s severity. Trump was impeached twice by the House of Representatives—first in 2019 for abuse of power and obstruction, and again in 2021 for incitement of insurrection—but was acquitted by the Senate both times. After losing the 2020 election to Joe Biden, Trump challenged the results, culminating in the January 6, 2021, Capitol riot. He remains a central figure in American politics, having won the 2024 presidential election and returned as the 47th president in 2025, continuing to promote policies aimed at economic growth, border security, and military strength[1][2][3][4].

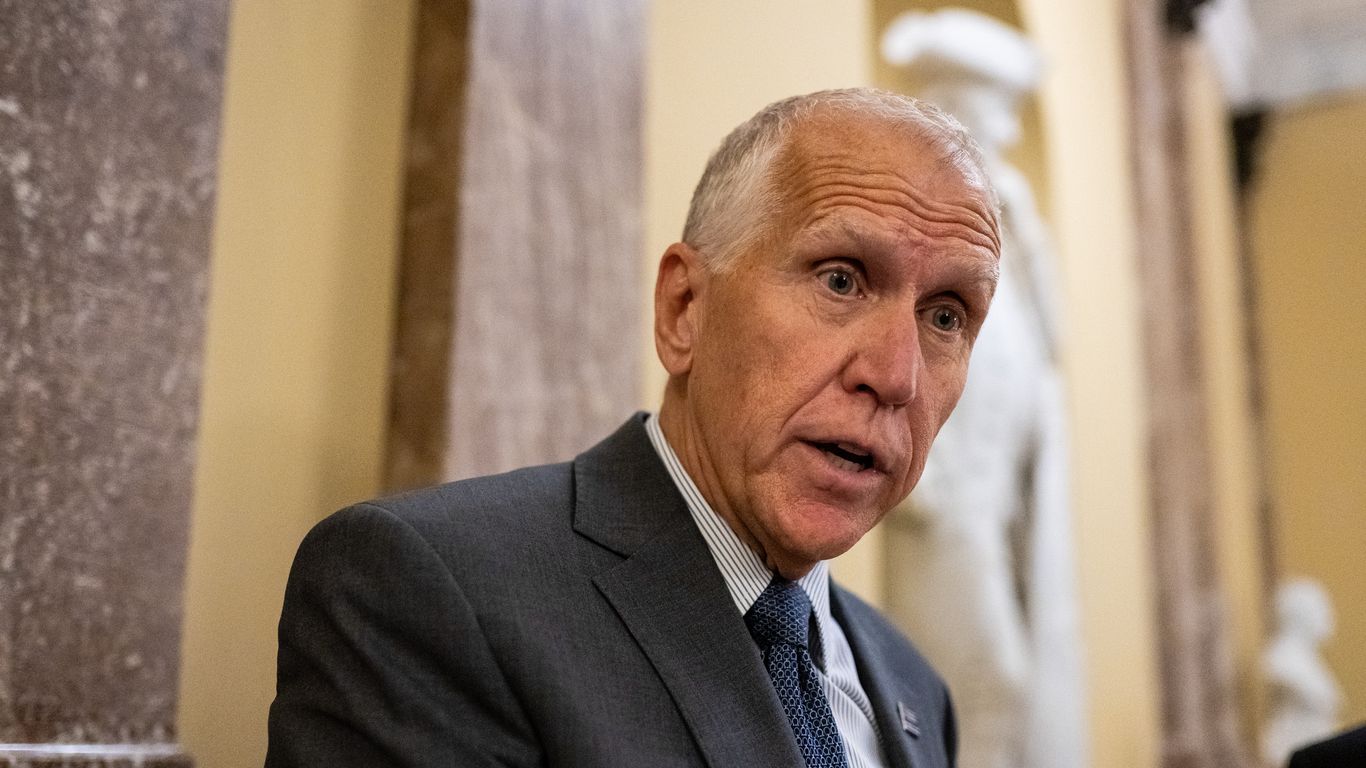

John Thune

John Thune is a U.S. Senator from South Dakota and the Senate Majority Leader as of 2025. Born in 1961 and raised in Murdo, South Dakota, Thune's interest in politics began early, influenced by a chance meeting with then-Rep. Jim Abdnor. He earned an undergraduate degree from Biola University and an MBA from the University of South Dakota. Early in his career, he worked for Senator Abdnor and the Small Business Administration under President Ronald Reagan. Returning to South Dakota in 1989, he held leadership roles including executive director of the state Republican Party and director of the State Railroad Division. Thune was first elected to the U.S. House of Representatives in 1996, serving three terms and gaining recognition for securing funding for state projects and advocating for smaller government and tax cuts. After narrowly losing a 2002 Senate race, he won a U.S. Senate seat in 2004 by defeating then-Senate Democratic Leader Tom Daschle, marking a historic upset. He has been reelected multiple times, including an unopposed Senate race in 2010. Throughout his Senate career, Thune has served on key committees such as Agriculture, Commerce, and Finance, and has held significant leadership positions including Senate Republican Whip and Chairman of the Senate Republican Conference. Known as a conservative Republican, he has focused on energy, agriculture, tax reform, and social issues. Notably, he introduced legislation to limit EPA regulatory authority and to repeal the federal estate tax. In 2024, Thune was elected Senate Majority Leader, assuming the role in 2025. He resides in Sioux Falls with his wife Kimberley; they have two daughters and six grandchildren. Outside politics, he enjoys pheasant hunting, running, and spending time with family[1][2][4][5][6].

About the Organizations Mentioned

GOP

The **GOP**, or **Grand Old Party**, is the widely recognized nickname for the **Republican Party** of the United States, a major conservative political party founded in 1854. It originated from anti-slavery activists opposing the Kansas-Nebraska Act, uniting former Whigs and Free Soilers with a platform centered on halting the expansion of slavery. The party's early historic milestone was the election of Abraham Lincoln in 1860, which precipitated the Civil War; under Lincoln’s leadership, the GOP focused on preserving the Union and abolishing slavery[1][2][3]. Throughout its history, the Republican Party has evolved from its abolitionist roots to champion business interests, industrial growth, and economic policies favoring limited government intervention. In the late 19th and early 20th centuries, it promoted protective tariffs and infrastructure development. The party experienced fluctuating influence, losing ground during the New Deal era but regaining prominence with Dwight D. Eisenhower’s presidency in the 1950s, marked by moderate conservatism[1][2]. Today, the GOP advocates for reduced taxes, conservative social policies, limited government regulation, strong national defense, and states’ rights. It remains one of the two dominant forces in American politics, consistently shaping legislative agendas and national discourse[2]. The party is organized and led nationally by the **Republican National Committee (RNC)**, which manages fundraising, election strategies, and the party platform, coordinating efforts across states and counties under the leadership of a chairman[3][4]. Notably, the acronym "GOP" was popularized in the late 19th century and originally stood for "Grand Old Party," symbolizing the party's legacy in preserving the Union and championing liberty. It is now a common term in political commentary and media[3][5]. In recent years, the GOP has undergone significant membership changes in Congress and leadership adjustments, reflecting its dynamic role in U.S. politics as

MAGA accounts

**MAGA accounts**, officially known as *Money Accounts for Growth and Advancement* and recently rebranded as *Trump Accounts*, are a proposed federal savings program designed to help American families invest in their children's futures starting in 2026[3][4][6]. The accounts target children under 8 years old, allowing parents, relatives, nonprofits, and other entities to contribute up to $5,000 annually, with no contribution limit for certain tax-exempt entities like private foundations[1][2][3]. The government seeds each eligible child's account with an initial $1,000 if the child is a U.S. citizen born between January 1, 2025, and December 31, 2028[2][4][6]. The funds in MAGA accounts are invested exclusively in low-cost, diversified U.S. equity index funds, excluding international diversification and active management, aiming for long-term growth through the stock market[1][2][3]. Withdrawals are restricted until the beneficiary turns 18, with limited access between ages 18 and 25, and tax advantages apply if funds are used for qualified expenses like higher education, business startup costs, or a first home purchase[1][3]. Non-qualified early withdrawals incur ordinary income tax and penalties[1]. The idea originated from Senator Ted Cruz, initially branded as "Invest America," before being renamed to the Trump-friendly MAGA Account by the House GOP, reflecting a blend of pro-family values and market-based wealth-building[6]. The program is administered by financial institutions and overseen by the U.S. Treasury Department[2][3]. Though not yet law, the MAGA account proposal is part of a broader Republican tax and savings initiative expected to cost trillions over a decade, aiming to promote generational wealth accumulation and financial inclusion through early investment[3][4][6]. Analysts project that the initial $1,000 contribution could grow substantially over decades, potentiall