How to Save Big with Trump and Biden's Car Tax Credits

Introduction

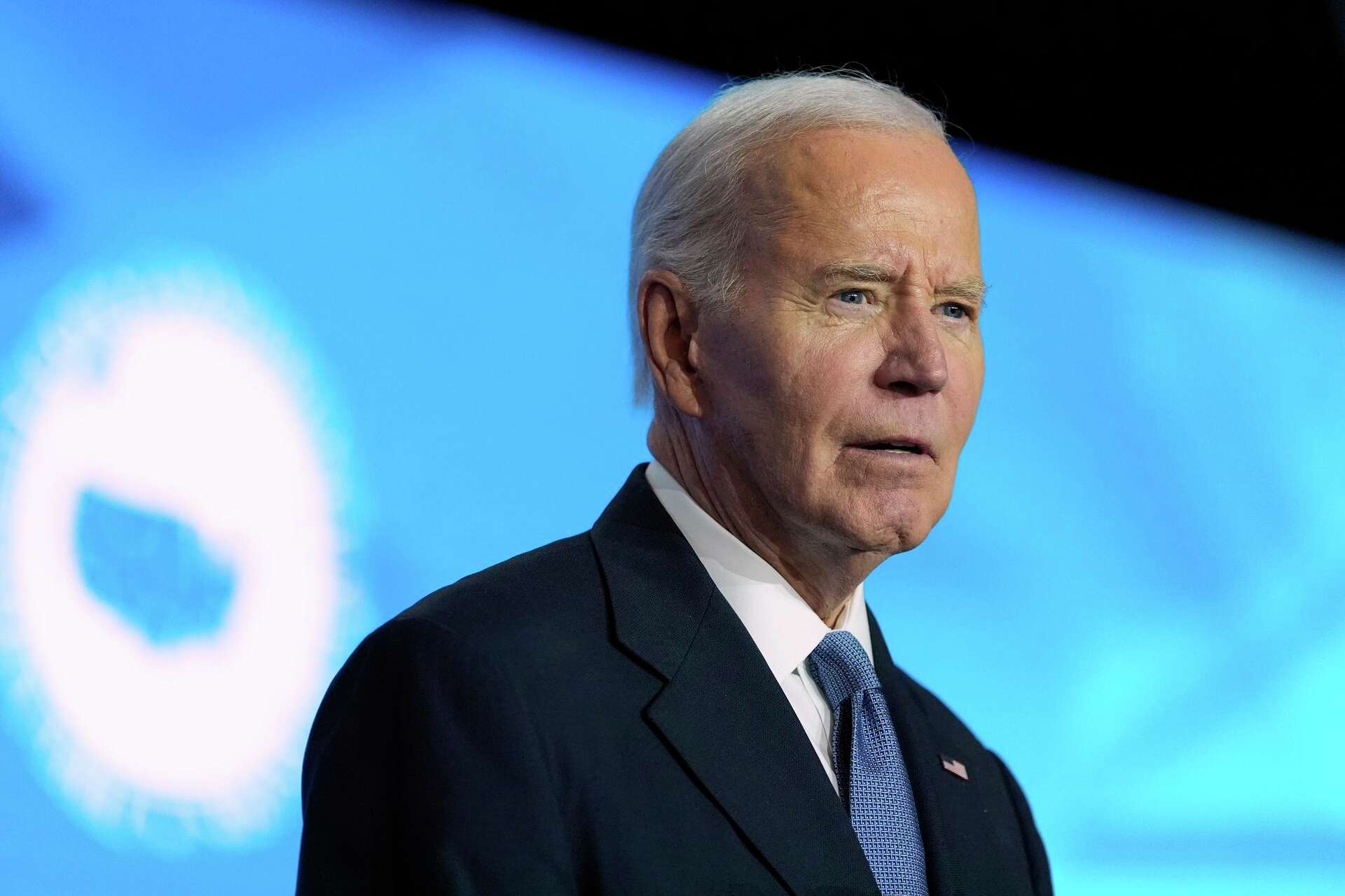

The debate between President Donald Trump and President Joe Biden is not only limited to their political ideologies, but also extends to their policies on car-buying incentives. Both presidents have introduced tax credits for new car purchases, but how can one take advantage of both of them? In this blog, we will explore the strategies to save thousands by stacking Trump's new-car tax credits with Biden's.

Background

In 2019, President Trump implemented a new-car tax credit to encourage consumers to buy American-made cars. This credit allows buyers to deduct up to $7,500 off their federal taxes. On the other hand, President Biden's recent stimulus plan includes a proposal for a new car tax credit of up to $12,500 for electric or zero-emission vehicles. This makes it the perfect time to purchase a new car and take advantage of both incentives.

Current Scenario

With the new tax credit from President Biden, the maximum deduction has increased to $12,500. This means that if you purchase an electric car for $40,000, you can deduct the entire amount from your federal taxes. However, the credit amount decreases as the price of the car increases. For example, if you purchase an electric car for $60,000, you can only deduct $7,500. This is where Trump's tax credit comes into play.

If you purchase a car that is eligible for both credits, you can stack them together and save even more. For instance, if you buy an electric car for $60,000, you can claim $7,500 from Trump's credit and $5,000 from Biden's credit. This brings your total deduction to $12,500, the maximum amount allowed by the new proposal.

How to Take Advantage

In order to take advantage of both tax credits, it is important to do your research and choose a car that is eligible for both incentives. This could either be an electric or zero-emission car that is also made in America. Additionally, it is important to act fast as the new proposal from President Biden is still in the works and may not be finalized until later this year.

Conclusion

By stacking Trump's new-car tax credit with Biden's, you can save thousands of dollars on your next car purchase. With the increasing popularity of electric cars, this is the perfect opportunity to take advantage of both incentives and make a smart investment. So, start researching and find the perfect car to stack these tax credits and save big on your new car.

About the Organizations Mentioned

Federal Government

The **Federal Government of the United States** is the national governing body established by the U.S. Constitution, operating under a system of federalism where power is shared between the national government and the 50 individual states[1][3]. It is divided into three distinct branches—**legislative**, **executive**, and **judicial**—each with constitutionally defined powers designed to balance and check one another to prevent any single branch from becoming too powerful[1][2][5]. The **legislative branch**, embodied by the bicameral Congress (the House of Representatives and the Senate), is responsible for creating laws, declaring war, regulating interstate and foreign commerce, and controlling federal taxing and spending policies[2][6]. The **executive branch**, headed by the President and including the Vice President and 15 Cabinet-level departments, enforces laws and manages federal agencies[2][6]. The **judicial branch** includes the U.S. Supreme Court and lower federal courts, tasked with interpreting laws and ensuring they comply with the Constitution[2][5][7]. Historically, the federal government was established in 1789 following the ratification of the Constitution, which laid the foundation for a representative democracy and division of powers. It has since grown to govern a nation of 50 states with diverse populations and territories, including the District of Columbia and sovereign Indigenous tribes under federal jurisdiction[1][4]. The government’s structure symbolizes stability and democratic governance, with Washington, D.C. serving as the central seat of power[1][4]. Key achievements include establishing a comprehensive legal framework that balances federal and state powers, managing national defense and foreign policy, and continually adapting to technological and societal changes. The government oversees numerous agencies that drive innovation, security, and public services, such as the Federal Bureau of Investigation and National Oceanic and Atmospheric Administration[1]. Today, the federal government remains a critical institution influencing business, technology, and societal progress, maintaining constitutiona