SoftBank's Potential Acquisition of Intel's Contract Chipmaking Business

Introduction

SoftBank, a Japanese group, has recently held talks with Intel about potentially acquiring their contract chipmaking business. This news comes as Intel has been struggling to attract customers and keep up with competition from their rival TSMC, a Taiwanese semiconductor company. The talks between SoftBank and Intel highlight the growing demand for advanced chip manufacturing capabilities in the global market. As technology continues to advance, companies are seeking to secure reliable and efficient sources for their chip production needs.

Key Details

SoftBank's interest in Intel's contract chipmaking business is not surprising, given their recent investments in the technology sector. The Japanese conglomerate has shown a strong focus on technology, with their SoftBank Vision Fund investing in companies such as Uber, WeWork, and Slack. With this potential acquisition, SoftBank could expand their influence in the chip manufacturing industry.

Intel's struggles in the contract chipmaking business have been well-documented, with their market share declining in recent years. The company has faced challenges in keeping up with the demand for advanced chips, causing customers to turn to competitors such as TSMC. If the talks with SoftBank are successful, it could be a significant move for Intel in regaining their position in the market.

Impact

If SoftBank does acquire Intel's contract chipmaking business, it could have a significant impact on the

About the Organizations Mentioned

SoftBank

SoftBank Group Corp. is a Japanese multinational investment holding company headquartered in Tokyo, renowned for its bold bets on transformative technologies. Founded in 1981 by Masayoshi Son, SoftBank has evolved from a software distributor into one of the world’s most influential tech investors, managing over $100 billion through its Vision Fund—the largest technology-focused venture capital fund globally. The company’s portfolio spans robotics, artificial intelligence, biotechnology, logistics, e-commerce, telecommunications, and more, with high-profile stakes in Arm (semiconductors), Alibaba (e-commerce), OYO Rooms (hospitality), WeWork (coworking), and Deutsche Telekom (telecom). A defining moment in SoftBank’s history was its landmark $32 billion acquisition of Arm Holdings in 2016, cementing its role in shaping the future of computing. In 2016, Son also pledged $50 billion in U.S. investments, promising to create 50,000 jobs—a move that underscored SoftBank’s global ambitions. The company is known for its aggressive investment strategy, often backing ambitious startups and unicorns, though not all have been profitable. Today, SoftBank operates as a pure holding company with 965 subsidiaries and over 67,000 employees worldwide. Its vision centers on accelerating human progress through technology, aiming for sustainable growth over the next 300 years. The group emphasizes sustainability, earning top certifications for women’s advancement and strong environmental scores. SoftBank’s leadership, led by Son, continues to drive innovation, balancing risk and opportunity in an ever-changing global tech landscape. With its finger on the pulse of emerging technologies, SoftBank remains a pivotal force in shaping the future of business and technology.

Intel

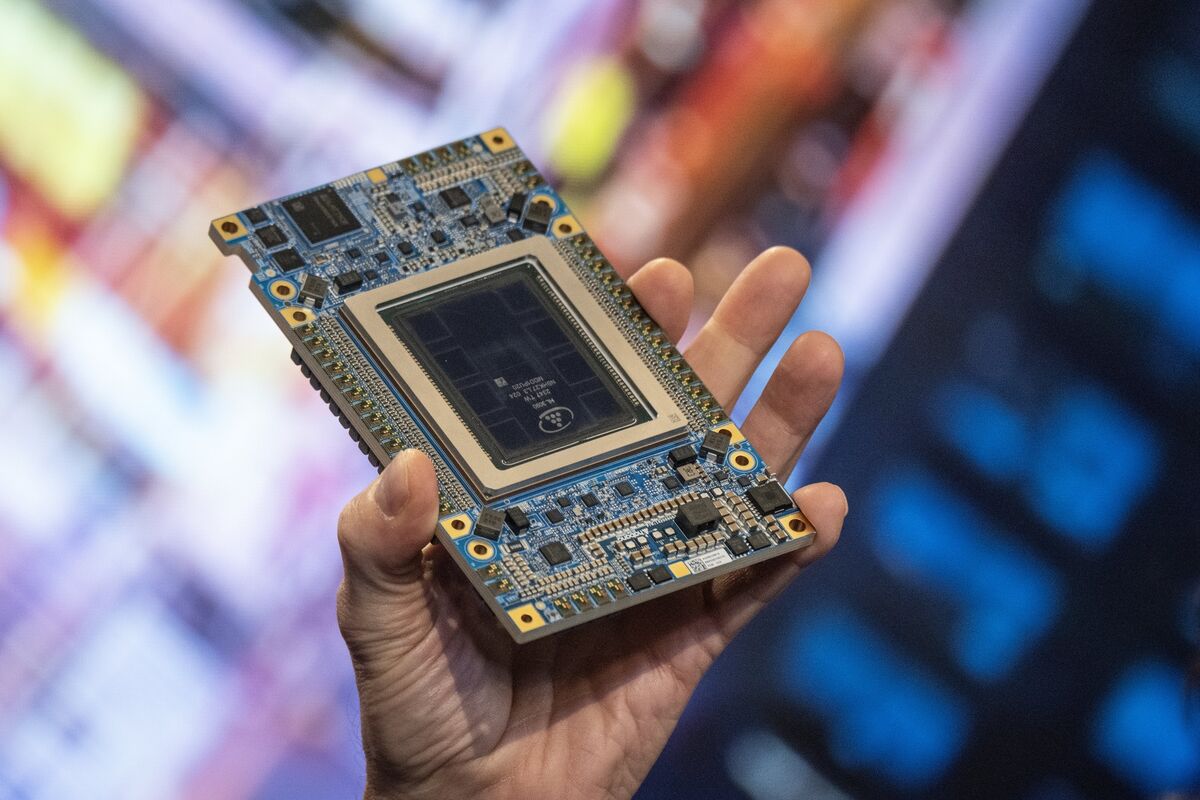

Intel Corporation is a leading American multinational technology company specializing in the design and manufacture of advanced semiconductors that power computing devices globally. Founded in 1968, Intel pioneered the development of microprocessors, becoming the dominant supplier of x86-based processors for PCs, servers, and other computing platforms. The company is known for its continuous innovation in semiconductor technology and its role in shaping the modern computing landscape. Intel's recent technological advancements include the launch of the Intel® Core™ Ultra series 3 processors (code-named Panther Lake) and Intel® Xeon® 6+ processors (Clearwater Forest), both built on the cutting-edge Intel 18A semiconductor node—currently the most advanced manufacturing node in the United States. These products are manufactured at Intel’s state-of-the-art Fab 52 facility in Chandler, Arizona, showcasing Intel's commitment to domestic production and technological leadership[1]. In the face of intense competition from rivals such as AMD and the architectural shifts exemplified by Apple’s move to its own silicon, Intel has been undergoing significant restructuring. This includes workforce reductions by approximately 15%, aiming to streamline operations, improve efficiency, and focus on core growth areas like AI and data centers. Financially, Intel reported solid demand and revenue resilience, with Q2 2025 revenue reaching $12.9 billion, exceeding guidance despite challenges from one-time costs and impairments[3][5]. The company is also enhancing its foundry business and AI roadmap to strengthen its competitive position and long-term shareholder value[3]. Intel’s strategic partnerships, including a $5 billion investment by Nvidia to jointly develop CPUs, and talks of adding AMD as a foundry customer, highlight its adaptive approach to industry dynamics[6]. Despite recent challenges and market shifts, Intel remains a crucial player in the semiconductor industry, advancing AI-enabled platforms and maintaining a significant impact on the global technology ecosystem[1][6].

TSMC

Taiwan Semiconductor Manufacturing Company Limited (TSMC) is a Taiwanese multinational semiconductor contract manufacturer renowned as the world's largest dedicated independent ("pure-play") semiconductor foundry. Founded in 1987 by Morris Chang, TSMC pioneered the pure-play foundry model, focusing exclusively on semiconductor manufacturing rather than chip design or product sales, which set it apart from integrated device manufacturers like Intel or Samsung[1][2]. This strategic focus enabled TSMC to establish economies of scale and become a critical manufacturing partner for semiconductor design companies worldwide, dominating approximately 64% of the global pure-play foundry market by 2024[2]. Headquartered in Hsinchu Science Park, Taiwan, TSMC has grown to become one of the most valuable semiconductor companies globally and Taiwan's largest firm, contributing about 30% to the Taiwan Stock Exchange's main index and playing a significant role in Taiwan’s economy, with integrated circuit exports worth $184 billion in 2022[1]. TSMC went public on the Taiwan Stock Exchange in 1993 and was the first Taiwanese company listed on the New York Stock Exchange in 1997[1]. Technologically, TSMC is at the forefront of semiconductor innovation, specializing in advanced nanoscale manufacturing processes. It was the first to commercialize extreme-ultraviolet (EUV) lithography with its N7+ process, offering significant improvements in transistor density and power efficiency compared to previous technologies. By 2024, it mass-produced 3-nanometer chips and was developing 2-nanometer process technology, maintaining leadership over competitors like Intel and Samsung[1][2]. TSMC has also embarked on major global expansion initiatives, including a $40 billion semiconductor fabrication plant in Arizona, set to begin operations around 2027-2028, as well as fabs in Japan and Germany. These expansions align with global efforts, such as the U.S. CHIPS Act, to boost domestic semiconductor manufacturing and R&