Stock Futures Flat Ahead of Inflation Data

Introduction

Stock futures are flat as investors await more inflation data, following a strong performance on Wall Street. On Wednesday, the S&P 500 and Nasdaq both hit new record highs, with the Dow Jones Industrial Average also experiencing a significant increase. This has been driven by positive earnings reports and optimism surrounding the economic recovery.

Key Details

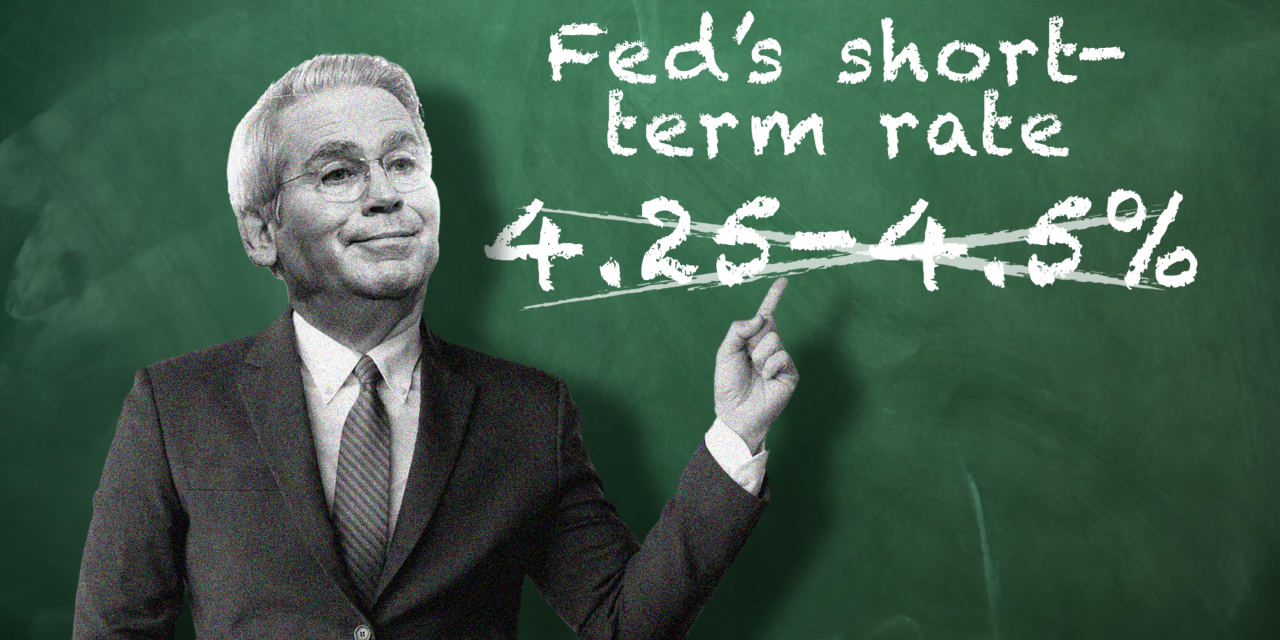

The market is closely watching inflation data, as rising prices could potentially impact the stock market. The Federal Reserve has assured that any increase in inflation will be temporary and they will continue to support the economy. However, if inflation continues to rise, it may lead to a change in the Fed's monetary policy, which could affect stock prices.

Another factor to consider is the ongoing COVID-19 pandemic and its impact on the economy. The recent surge in cases due to the Delta variant has raised concerns about the pace of the recovery. This uncertainty may be contributing to the flat futures market.

Impact

Investors will be closely monitoring the release of key inflation data and its potential impact on the stock market. This will provide insight into the strength of the economic recovery and the Fed's future actions. Additionally, the ongoing pandemic and its effect on the economy may also play a role in market performance. As always, it is important for investors to remain cautious and stay informed about any potential changes in the market.

## Overview and Mission

The Federal Reserve, often called the "Fed," is the central bank of the United States, established by Congress in 1913 to provide the nation with a safer, more flexible, and stable monetary and financial system[1]. Its mission centers on a dual mandate from Congress: to promote maximum employment and maintain price stability, ensuring the dollar retains its value over time[1]. The Fed operates through a unique hybrid structure, combining a national Board of Governors in Washington, D.C., with 12 independent regional Reserve Banks, including institutions like the Cleveland Fed[1]. This decentralized setup allows the Fed to closely monitor economic conditions across diverse regions, industries, and communities, while maintaining independence from short-term political influences[1].

## Key Functions

The Fed’s responsibilities are broad and vital to the U.S. economy. It conducts monetary policy—primarily by influencing interest rates—to achieve its employment and inflation goals[2]. The Fed also supervises and regulates banks to ensure the safety and soundness of the financial system, works to minimize systemic risks, and fosters efficient payment and settlement systems[2]. Additionally, it promotes consumer protection and community development, addressing emerging issues through research, supervision, and enforcement of consumer laws[2].

## History and Evolution

The Federal Reserve is the third central bank in U.S. history, following two failed attempts in the 19th century[1]. Its creation was a response to the financial turbulence of the early 20th century, aiming to prevent crises and stabilize the economy. Over time, the Fed has evolved, adopting more transparent and inclusive policymaking processes. For example, it now conducts regular reviews of its monetary policy framework, engaging with academics, businesses, and the public to refine its strategies and communications[3][5].

## Recent Developments and Achievements

In 2025, the Fed completed its second major review of its monetary policy strategy, tools, and communications, reaffirming its commitment to transparenc Discover related stories and their connections to this article Explore connected events with detailed insights and relationships Key entities mentioned across connected events Discover patterns and trends across related stories UK youth unemployment climbs to 957,000 in late 2025, with 16.1% unemployment among 16-24s; urgent policy action needed. US weekly unemployment claims rose to 212k as traders watch Fed cues and market signals. Asian stocks slip as tech weakness weighs on markets, with Korea and Japan eyeing gains amid supportive data. Stock futures tumble after GDP shows 1.4% growth in Q4 2025, signaling slower momentum and potential rate cuts in 2026. Stellantis reports 2025 results with a €22.3B net loss amid €25.4B charges, outlining a strategic reset and growth plan for 2026.About the Organizations Mentioned

Federal Reserve

🔗 Connected Events Overview

📊 Quick Insights

📅 Connected Events Timeline

👥 People Involved in Connected Events

Connected through:

🏢 Organizations & Products

🏢 Organizations

🛍️ Products

💡 Connected Events Insights

🔥 Trending Topics

Trending Blogs in Business

UK Youth Unemployment Nears Crisis Point: 957,000 NEETs in Late 2025

US Unemployment Claims Rise Slightly, Fed Cues in Focus

Asia Stocks Dip Amid Tech Weakness: Korea and Japan Eye Gains

Stock Futures Plunge on Disappointing GDP Data

![]()

Stellantis Financial Reset 2025: Navigating Losses Toward Growth

:max_bytes(150000):strip_icc()/GettyImages-22277232031-629ef0d5ef894388a74cecdec20f17b9.jpg)