Supreme Court Delays Decision on Trump's Request to Remove Federal Reserve Governor

Supreme Court Delays Decision on Trump's Request to Remove Federal Reserve Governor

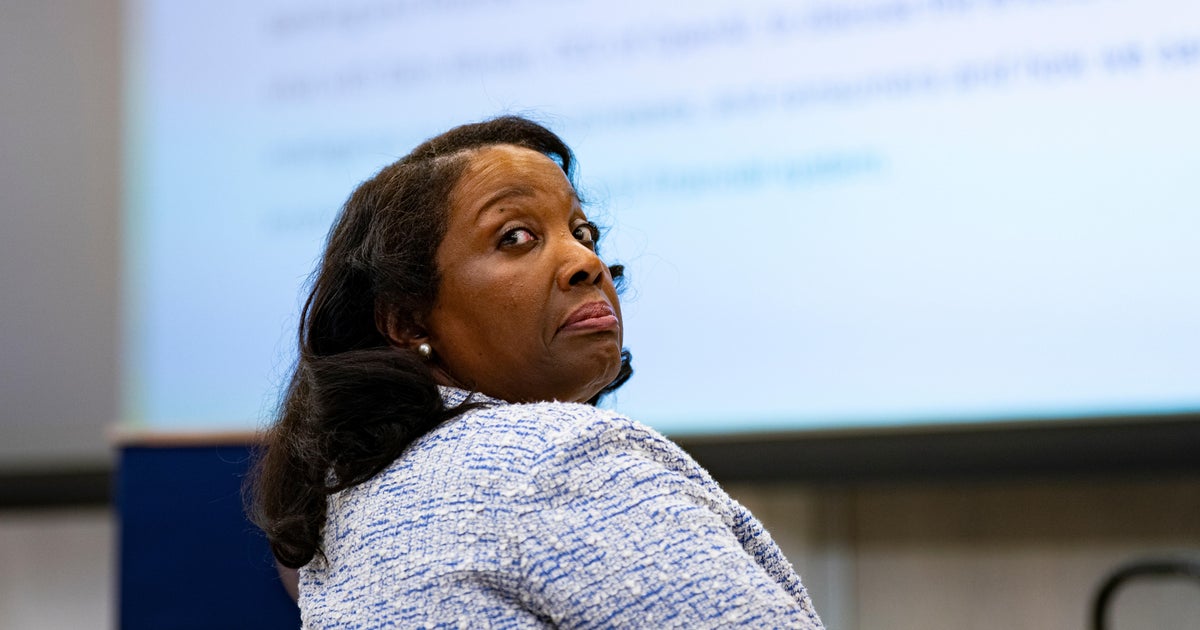

Chief Justice John Roberts has requested a response from Federal Reserve Governor Lisa Cook by Sept. 25 regarding President Donald Trump's bid to immediately remove her from office. This decision has been met with both relief and concern from the public and government officials alike.

The Background

The tension between Trump and Cook has been ongoing, with Trump accusing Cook of not being supportive enough of his economic policies. This request to remove her from her position is just the latest in their ongoing dispute.

Cook, who was appointed to the Federal Reserve in 2014, is known for her expertise in labor economics and has been a vocal advocate for diversity and inclusion in the Federal Reserve. Many are concerned that her removal could hinder the progress she has made in these areas.

The Implications

This delay in the Supreme Court's decision has given Cook more time to prepare her response and gather support from her colleagues. While the outcome of this situation is still uncertain, it has sparked conversations about the independence of the Federal Reserve and the potential impact of political interference.

About the People Mentioned

Lisa Cook

Lisa DeNell Cook (born 1964) is an American economist and a member of the Federal Reserve Board of Governors, having assumed office in May 2022 and reappointed in September 2023 for a term ending in 2038. She is notable as the first African American woman to serve on the Federal Reserve Board[1][2][6][8]. Cook holds a BA in Physics and Philosophy from Spelman College, where she was the first Marshall Scholar, and earned a second BA in Philosophy, Politics, and Economics from Oxford University. She completed her Ph.D. in Economics at the University of California, Berkeley, specializing in macroeconomics and international economics[2][3][6]. Her academic career includes faculty positions at Harvard University's Kennedy School of Government (1997–2002), where she was deputy director of Africa Research at the Center for International Development, and Michigan State University, where she has been a professor of economics and international relations since 2005 and gained tenure in 2013[1][2][3][6]. She was also a National Fellow at Stanford University's Hoover Institution (2002–2005). Cook has held significant advisory roles, including senior economist on the Obama Administration’s Council of Economic Advisers (2011–2012) and senior advisor on finance and development at the U.S. Treasury Department (2000–2001). She advised the Nigerian government on banking reforms and Rwanda on economic development[1][2][6]. Her research spans international economics, economic growth, innovation, financial markets, and the economic history of African Americans, notably linking racial violence during Jim Crow to suppressed patent activity. She also leads efforts to promote diversity in economics, directing the American Economic Association’s Summer Program for underrepresented minority students and serving on its Executive Committee[1][5][6]. In 2020, Cook contributed to the Biden presidential transition team’s review of financial regulatory agencies. She has also served on the board of directors of the Federal Reserve Bank of Chicago and the Federal Home Loan Bank of Indianapolis[1][5]. Cook is recognized for her scholarship, public service, and advocacy for inclusion in economics, and has been honored as a leading Black economist by Fortune magazine[5].

About the Organizations Mentioned

Federal Reserve

## Overview and Mission The Federal Reserve, often called the "Fed," is the central bank of the United States, established by Congress in 1913 to provide the nation with a safer, more flexible, and stable monetary and financial system[1]. Its mission centers on a dual mandate from Congress: to promote maximum employment and maintain price stability, ensuring the dollar retains its value over time[1]. The Fed operates through a unique hybrid structure, combining a national Board of Governors in Washington, D.C., with 12 independent regional Reserve Banks, including institutions like the Cleveland Fed[1]. This decentralized setup allows the Fed to closely monitor economic conditions across diverse regions, industries, and communities, while maintaining independence from short-term political influences[1]. ## Key Functions The Fed’s responsibilities are broad and vital to the U.S. economy. It conducts monetary policy—primarily by influencing interest rates—to achieve its employment and inflation goals[2]. The Fed also supervises and regulates banks to ensure the safety and soundness of the financial system, works to minimize systemic risks, and fosters efficient payment and settlement systems[2]. Additionally, it promotes consumer protection and community development, addressing emerging issues through research, supervision, and enforcement of consumer laws[2]. ## History and Evolution The Federal Reserve is the third central bank in U.S. history, following two failed attempts in the 19th century[1]. Its creation was a response to the financial turbulence of the early 20th century, aiming to prevent crises and stabilize the economy. Over time, the Fed has evolved, adopting more transparent and inclusive policymaking processes. For example, it now conducts regular reviews of its monetary policy framework, engaging with academics, businesses, and the public to refine its strategies and communications[3][5]. ## Recent Developments and Achievements In 2025, the Fed completed its second major review of its monetary policy strategy, tools, and communications, reaffirming its commitment to transparenc