The Dot Plot: A Key Tool for Understanding the Federal Reserve

Introduction

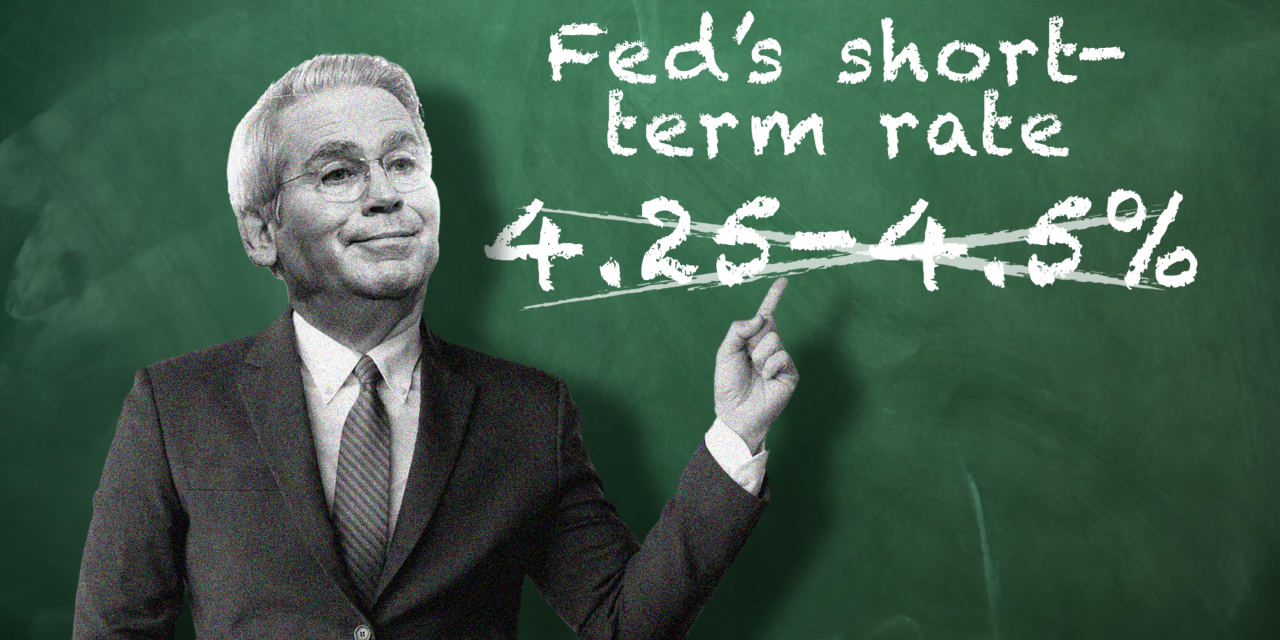

The Federal Reserve is responsible for controlling the interest rates in the United States. Every three months, the central bank releases a scatter chart called the "Dot Plot" that displays the future forecast for interest rates as determined by top officials. This chart is heavily scrutinized and analyzed by investors, economists, and financial experts in order to gain insights into the future of the economy and financial markets.

Key Details

The Dot Plot is made up of anonymous projections, meaning that individual officials are not identified by name. This has caused some controversy, with some arguing that the lack of transparency makes it difficult for the public to fully understand the decision-making process. Additionally, the Dot Plot is not always a reliable indicator, as it is subject to change based on economic conditions and other factors. However, it does provide valuable information and insights into the thinking of the Federal Reserve and can be used as a tool for investors to make informed decisions.

Impact

The Dot Plot has a significant impact on the financial world, as it can influence the stock market, bond yields, and other crucial economic factors. It also serves as a key tool for the Federal Reserve to communicate its monetary policy and future plans to the public. While not everyone is a fan of the Dot Plot, it remains an important piece of data for understanding the direction of interest rates and the economy as a whole.

About the Organizations Mentioned

Federal Reserve

## Overview and Mission The Federal Reserve, often called the "Fed," is the central bank of the United States, established by Congress in 1913 to provide the nation with a safer, more flexible, and stable monetary and financial system[1]. Its mission centers on a dual mandate from Congress: to promote maximum employment and maintain price stability, ensuring the dollar retains its value over time[1]. The Fed operates through a unique hybrid structure, combining a national Board of Governors in Washington, D.C., with 12 independent regional Reserve Banks, including institutions like the Cleveland Fed[1]. This decentralized setup allows the Fed to closely monitor economic conditions across diverse regions, industries, and communities, while maintaining independence from short-term political influences[1]. ## Key Functions The Fed’s responsibilities are broad and vital to the U.S. economy. It conducts monetary policy—primarily by influencing interest rates—to achieve its employment and inflation goals[2]. The Fed also supervises and regulates banks to ensure the safety and soundness of the financial system, works to minimize systemic risks, and fosters efficient payment and settlement systems[2]. Additionally, it promotes consumer protection and community development, addressing emerging issues through research, supervision, and enforcement of consumer laws[2]. ## History and Evolution The Federal Reserve is the third central bank in U.S. history, following two failed attempts in the 19th century[1]. Its creation was a response to the financial turbulence of the early 20th century, aiming to prevent crises and stabilize the economy. Over time, the Fed has evolved, adopting more transparent and inclusive policymaking processes. For example, it now conducts regular reviews of its monetary policy framework, engaging with academics, businesses, and the public to refine its strategies and communications[3][5]. ## Recent Developments and Achievements In 2025, the Fed completed its second major review of its monetary policy strategy, tools, and communications, reaffirming its commitment to transparenc