Trump and Johnson Race to Secure Support for Tax Bill

Introduction

As the July 4th deadline approaches, President Donald Trump and Prime Minister Boris Johnson are in a race to secure support for their highly anticipated tax bill. However, they are facing significant opposition from within their own party. The Washington Post reports that some House GOP members are hesitant to back the bill due to concerns over its rising cost and cuts to Medicaid. This has put both leaders in a tight spot as they scramble to get the necessary votes before the holiday break.

Background

The Trump administration has been pushing for a major tax overhaul since taking office, and the Senate GOP is determined to meet the President's deadline. However, the legislation has faced numerous obstacles, with Republicans struggling to reconcile competing demands and garner enough support to pass the bill. This has resulted in a series of negotiations and revisions, with the current version including a controversial provision known as "MAGA accounts" that would allow individuals to invest in the stock market without paying capital gains taxes.

Current Scenario

The House GOP is dealing with a significant number of dissenting members, including Senator Thom Tillis of North Carolina who recently announced he will not be seeking re-election. Additionally, Senate Majority Leader John Thune is facing approximately eight Republican senators who have expressed opposition to the bill. Despite these challenges, Republicans are determined to push the bill through and are willing to make concessions to secure the necessary votes.

However, the bill's ballooning price and cuts to Medicaid have raised concerns among fiscal hawks and moderate conservatives. The legislation would add an estimated $550 billion in interest payments to the national debt, and has been met with criticism for its potential impact on the economy and the American people. Some have even expressed concerns over the flippant defenses of Trump's agenda and the potential consequences of such a massive overhaul.

With the July 4th deadline looming, it remains to be seen if Trump and Johnson will be able to secure the necessary support for their tax bill. As the negotiations continue, the House GOP is under pressure to find a compromise that will satisfy both sides and move the bill forward. The coming days and weeks will be crucial in determining the fate of this highly debated legislation.

About the People Mentioned

Donald Trump

Donald John Trump, born June 14, 1946, in Queens, New York, is an American businessman, media personality, and politician. He graduated from the University of Pennsylvania’s Wharton School in 1968 with a degree in economics. In 1971, he took over his family’s real estate business, renaming it the Trump Organization, through which he expanded into building and managing skyscrapers, hotels, casinos, and golf courses. Trump gained widespread fame as the host of the reality TV show *The Apprentice* from 2004 to 2015, which helped establish his public persona as a successful entrepreneur. Trump entered politics as a Republican and was elected the 45th president of the United States, serving from 2017 to 2021. His presidency was marked by significant policy actions including tax cuts, deregulation, the appointment of three Supreme Court justices, renegotiation of trade agreements (notably replacing NAFTA with the USMCA), and a focus on immigration control including border wall expansion. He withdrew the U.S. from international agreements such as the Paris Climate Accord and the Iran nuclear deal, and engaged in a trade war with China. His administration’s response to the COVID-19 pandemic was criticized for downplaying the virus’s severity. Trump was impeached twice by the House of Representatives—first in 2019 for abuse of power and obstruction, and again in 2021 for incitement of insurrection—but was acquitted by the Senate both times. After losing the 2020 election to Joe Biden, Trump challenged the results, culminating in the January 6, 2021, Capitol riot. He remains a central figure in American politics, having won the 2024 presidential election and returned as the 47th president in 2025, continuing to promote policies aimed at economic growth, border security, and military strength[1][2][3][4].

Boris Johnson

Boris Johnson, born on June 19, 1964, in New York City, is a prominent British politician and former journalist. He is best known for serving as the Prime Minister of the United Kingdom from 2019 until his resignation in 2022. Johnson's educational background includes attending Eton College and Balliol College, Oxford, where he was elected president of the Oxford Union in 1986[4]. Johnson began his career in journalism, working for publications like *The Daily Telegraph* and serving as the editor of *The Spectator* from 1999 to 2005[4]. He entered politics, becoming a Member of Parliament (MP) for Henley in 2001 and later for Uxbridge and South Ruislip from 2015 until his resignation in June 2023[4][6]. Notably, Johnson served as Mayor of London from 2008 to 2016, introducing initiatives such as the "Boris Bikes" cycle-sharing program[5]. He was also Foreign Secretary from 2016 to 2018[4][6]. Johnson played a pivotal role in the Brexit campaign, leading the "Leave" movement to a historic victory in the 2016 EU referendum[5]. As Prime Minister, he navigated the UK through the Brexit process and the COVID-19 pandemic, although his tenure was marked by controversies, including the "Partygate" scandal[2][4]. Despite his resignation as Prime Minister and later as MP, Johnson remains an influential figure in British politics and media[2][4]. In 2024, he published a memoir titled *Unleashed*[2]. His influence continues, reflecting a blend of charisma and controversy throughout his career.

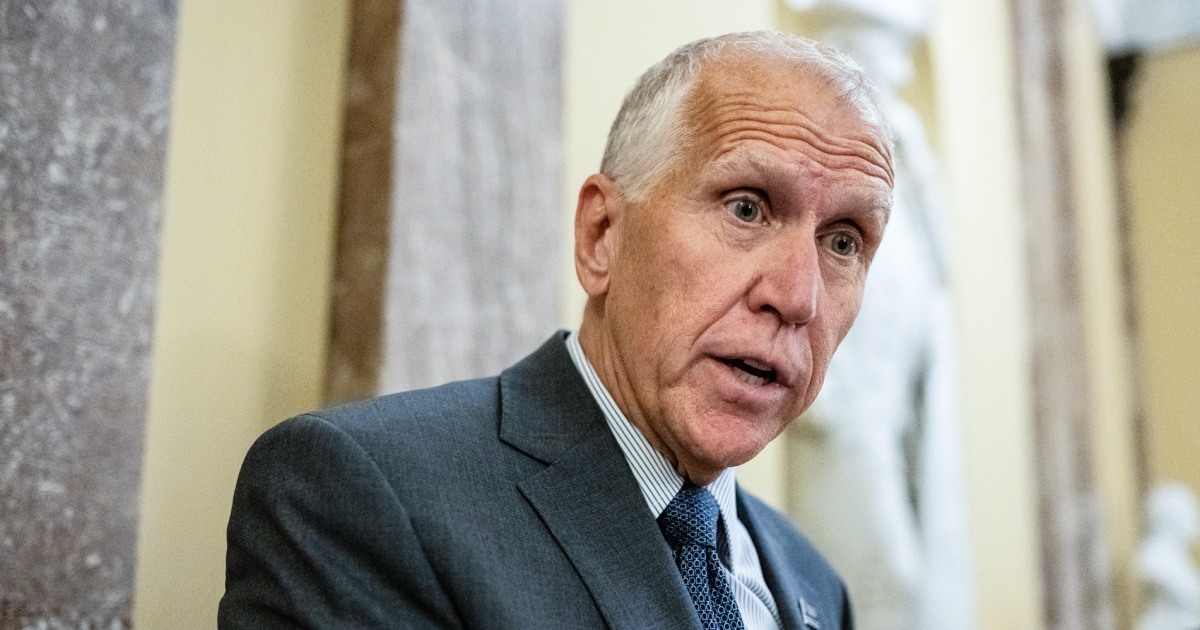

Thom Tillis

Thomas Roland Tillis, known as Thom Tillis, is an American politician serving as the U.S. Senator for North Carolina. Born on August 30, 1960, in Jacksonville, Florida, Tillis grew up in a working-class family and faced financial challenges early in life. After high school, he worked as a warehouse records clerk before pursuing higher education, earning a bachelor's degree from the University of Maryland University College in 1997[1][2]. Tillis built a successful career in the private sector, working as an executive at IBM and a partner at PricewaterhouseCoopers. His 29-year tenure in technology and management consulting provided him with a deep understanding of policy-making and organizational management[2][4]. He transitioned into public service, serving as a member of the Cornelius Board of Commissioners and later as the PTA president at Hopewell High School. In 2006, he was elected to the North Carolina House of Representatives, where he served as Speaker from 2011 to 2014[2][3]. Tillis was first elected to the U.S. Senate in 2014 and re-elected in 2020. He is a member of several key Senate committees, including Finance, Veterans’ Affairs, and Judiciary[3][5]. As Senator, Tillis has focused on pragmatic policy solutions and job creation. Recently, he has been involved in sponsoring legislation such as the National Park System Long-Term Lease Investment Act[5]. Tillis resides in Huntersville, North Carolina, with his wife Susan, and they have two grown children[2][3].

John Thune

John Thune is a U.S. Senator from South Dakota and the Senate Majority Leader as of 2025. Born in 1961 and raised in Murdo, South Dakota, Thune's interest in politics began early, influenced by a chance meeting with then-Rep. Jim Abdnor. He earned an undergraduate degree from Biola University and an MBA from the University of South Dakota. Early in his career, he worked for Senator Abdnor and the Small Business Administration under President Ronald Reagan. Returning to South Dakota in 1989, he held leadership roles including executive director of the state Republican Party and director of the State Railroad Division. Thune was first elected to the U.S. House of Representatives in 1996, serving three terms and gaining recognition for securing funding for state projects and advocating for smaller government and tax cuts. After narrowly losing a 2002 Senate race, he won a U.S. Senate seat in 2004 by defeating then-Senate Democratic Leader Tom Daschle, marking a historic upset. He has been reelected multiple times, including an unopposed Senate race in 2010. Throughout his Senate career, Thune has served on key committees such as Agriculture, Commerce, and Finance, and has held significant leadership positions including Senate Republican Whip and Chairman of the Senate Republican Conference. Known as a conservative Republican, he has focused on energy, agriculture, tax reform, and social issues. Notably, he introduced legislation to limit EPA regulatory authority and to repeal the federal estate tax. In 2024, Thune was elected Senate Majority Leader, assuming the role in 2025. He resides in Sioux Falls with his wife Kimberley; they have two daughters and six grandchildren. Outside politics, he enjoys pheasant hunting, running, and spending time with family[1][2][4][5][6].

About the Organizations Mentioned

Washington Post

The Washington Post is a leading American daily newspaper headquartered in Washington, D.C., known for its influential political reporting and broad national audience. Founded in 1877 by Stilson Hutchins, it initially struggled financially and editorially until 1933, when financier Eugene Meyer purchased it out of bankruptcy and revitalized its reputation. The paper’s guiding principle, established by Meyer, was to "tell ALL the truth so far as it can learn it," setting a standard for rigorous journalism[1][2][4]. Under the leadership of the Meyer-Graham family—particularly Philip Graham, Katharine Graham, and later Donald Graham—the Post became a dominant force in American journalism. It expanded by acquiring rival publications and became Washington's principal morning newspaper, eventually holding a near-monopoly status in the region[1][4]. The paper gained international prominence for its pivotal role in publishing the Pentagon Papers in 1971, which exposed government deception regarding the Vietnam War, and for investigative reporting by Bob Woodward and Carl Bernstein during the Watergate scandal, which led to President Richard Nixon’s resignation in 1974[2][5]. The Post has earned 76 Pulitzer Prizes, ranking second only to The New York Times, and is regarded as a newspaper of record in the United States. Its journalists have received numerous prestigious awards, including Nieman Fellowships and White House News Photographers Association honors, reflecting its commitment to excellence in political and investigative journalism[2][5]. In 2013, the Graham family sold The Washington Post to Jeff Bezos, founder of Amazon, for $250 million, ushering in a new era focused on digital innovation and expanding its digital subscriber base, which reached 2.5 million by 2023. Despite a decline in print subscribers to below 100,000 by 2025, the Post remains a key player in business and technology news, maintaining foreign bureaus in London and Seoul to provide comprehensive global coverage[2]. Notable for its histori

Senate GOP

## Overview of Senate GOP The **Senate GOP**—officially the Senate Republican Conference—is the formal organization of Republican senators in the United States Senate. It serves as the central hub for coordinating legislative strategy, policy development, and communication for Republican members[1]. The organization’s primary function is to advance the party’s legislative agenda, manage floor proceedings, and act as the main voice for Republican senators in national debates[1]. ## History and Structure The Senate GOP’s structure has evolved with the Senate itself, but its modern form centers on elected leadership positions such as the Senate Majority Leader, the Republican Whip (officially titled the Assistant Majority Floor Leader), and other conference officers[1]. These leaders are chosen by their colleagues and are responsible for setting the legislative calendar, building consensus within the caucus, and negotiating with the opposing party and the executive branch[1]. The Majority Leader holds the most influential role, directing the flow of legislation and serving as the chief spokesperson for Senate Republicans[1]. ## Key Achievements and Role in Policy Historically, the Senate GOP has played a decisive role in shaping major legislation, particularly during periods of Republican majority control. Achievements have included tax reform, deregulation efforts, judicial confirmations, and national security policies. The organization’s ability to maintain party discipline and negotiate bipartisan agreements has often determined the success or failure of significant bills. During the 119th Congress (2025–2027), Republicans regained control of the Senate with a 53–47 majority (including two independents who caucus with Democrats), following the 2024 elections[3][6]. This shift returned committee chairmanships to Republicans, giving them substantial influence over key policy areas such as finance, judiciary, and energy[2]. The Senate GOP’s renewed majority also means greater leverage in advancing business-friendly policies, tech regulation, and oversight of the executive branch[2]. ## Current Status and Notable Aspects As