Asian Markets Follow Wall Street Gains Ahead of Nvidia Earnings

#asian_markets #wall_street #nvidia #earnings #federal_reserve

Introduction

Asian markets are expected to follow the footsteps of Wall Street and open with gains, ahead of artificial intelligence giant Nvidia's earnings announcement. This comes amidst speculations of a potential rate cut by the Federal Reserve, which could further boost investor sentiment.

Key Details

U.S. equity futures remain relatively unchanged, with the S&P 500 and the Dow Jones Industrial Average showing slight gains. The tech-heavy Nasdaq, however, is seen to open lower, as investors eagerly anticipate Nvidia's earnings report. The company's stock has been on a steady rise, with a 38% gain this year alone, making it a top performer in the S&P 500.

Impact

The potential rate cut by the Fed has been a major topic of discussion, as it could provide a much-needed boost to the economy. This, coupled with positive earnings from major companies like Nvidia, could continue to drive the market upwards. However, investors remain cautious as trade tensions between the U.S. and China continue to linger.

About the Organizations Mentioned

Nvidia

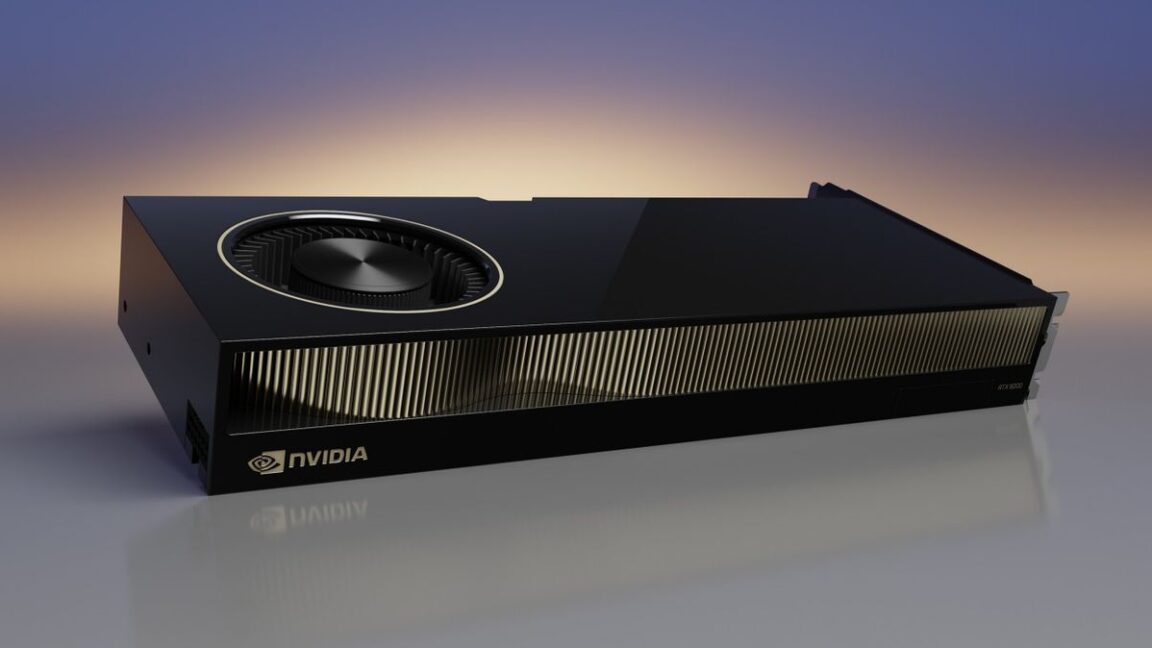

Nvidia Corporation, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem and headquartered in Santa Clara, California, is a pioneering American technology company best known for inventing the graphics processing unit (GPU) in 1999[1][2][4]. Initially focused on GPUs for video gaming, Nvidia has expanded its scope to serve diverse markets, including artificial intelligence (AI), high-performance computing (HPC), professional visualization, automotive technology, and mobile devices[1][3]. Nvidia’s GPUs, such as the GeForce series for gamers and the RTX series for professional applications, are central to its dominance, controlling over 90% of the discrete GPU market as of early 2025[1][4]. The company’s investment in CUDA, a parallel computing platform and API launched in the early 2000s, revolutionized GPU computing by enabling GPUs to accelerate a wide range of compute-intensive tasks, particularly in AI and scientific research[1][4]. By 2025, Nvidia commanded over 80% of the GPU market for AI training and inference and supplied chips to more than 75% of the world’s top 500 supercomputers[1]. Nvidia’s influence extends beyond hardware. It offers a comprehensive ecosystem including software platforms like Omniverse for 3D simulation and digital twins, AI frameworks such as MONAI for medical imaging, and Jetson for robotics and edge AI[2][3]. Its technologies power autonomous vehicle data centers, AI factories, and cloud gaming services like GeForce Now[2][7]. Financially, Nvidia achieved record full-year revenue of $130.5 billion in fiscal 2025, with a workforce of over 36,000 employees worldwide and a robust patent portfolio exceeding 8,700 applications[2]. The company is recognized for innovation and workplace excellence, topping Forbes’ "America’s Best Companies 2025" and Fast Company’s "World’s Most Innovative Companies"