Nvidia and Intel Partner to Revolutionize Semiconductor Industry

Introduction

In a surprising move, Nvidia, the leading semiconductor company, announced its plans to invest $5 billion in its longtime rival, Intel. This investment will not only strengthen their relationship but also pave the way for groundbreaking developments in the semiconductor industry.

Key Details

Nvidia has been at the forefront of the artificial intelligence revolution, and this investment is a strategic move to further solidify its position. With this stake in Intel, Nvidia will have access to the latter's advanced manufacturing capabilities, allowing them to develop cutting-edge chips. This partnership will also help Intel recover from its recent struggles and regain its position in the market.

Impact

This unexpected collaboration between two major players in the industry has the potential to change the game. With their combined expertise and resources, we can expect to see groundbreaking developments in the field of AI and advanced computing. This will not only benefit the two companies but also have a significant impact on the overall industry and its advancements. It also sends a positive message to other competitors, highlighting the potential for cooperation and growth in the semiconductor market.

About the Organizations Mentioned

Nvidia

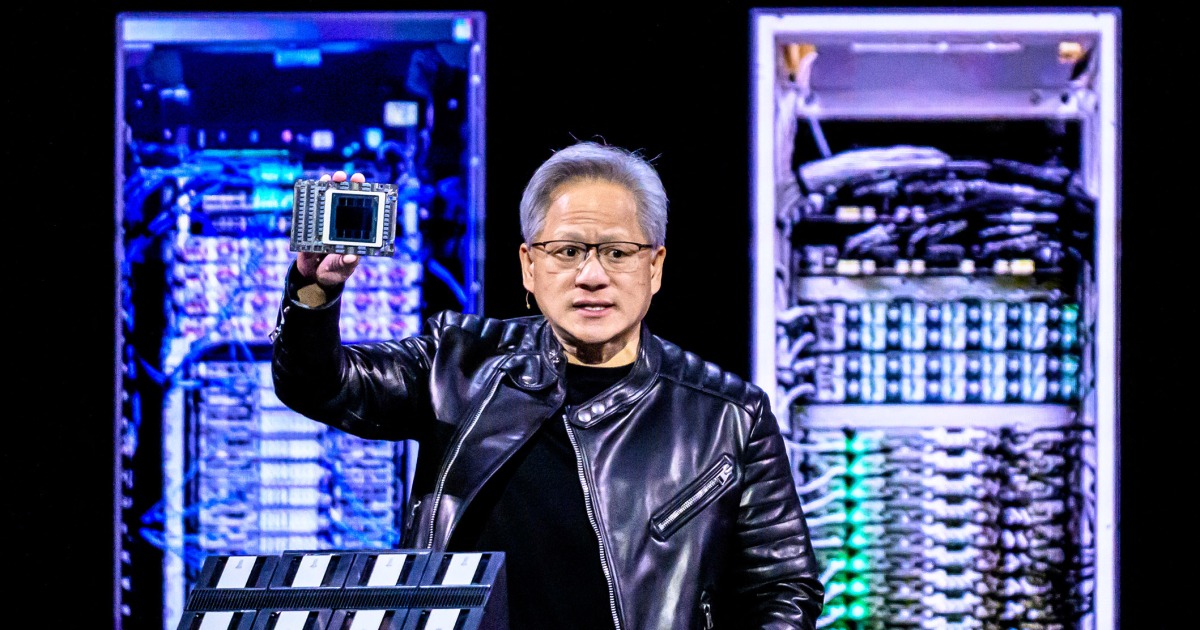

Nvidia Corporation, founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem and headquartered in Santa Clara, California, is a pioneering American technology company best known for inventing the graphics processing unit (GPU) in 1999[1][2][4]. Initially focused on GPUs for video gaming, Nvidia has expanded its scope to serve diverse markets, including artificial intelligence (AI), high-performance computing (HPC), professional visualization, automotive technology, and mobile devices[1][3]. Nvidia’s GPUs, such as the GeForce series for gamers and the RTX series for professional applications, are central to its dominance, controlling over 90% of the discrete GPU market as of early 2025[1][4]. The company’s investment in CUDA, a parallel computing platform and API launched in the early 2000s, revolutionized GPU computing by enabling GPUs to accelerate a wide range of compute-intensive tasks, particularly in AI and scientific research[1][4]. By 2025, Nvidia commanded over 80% of the GPU market for AI training and inference and supplied chips to more than 75% of the world’s top 500 supercomputers[1]. Nvidia’s influence extends beyond hardware. It offers a comprehensive ecosystem including software platforms like Omniverse for 3D simulation and digital twins, AI frameworks such as MONAI for medical imaging, and Jetson for robotics and edge AI[2][3]. Its technologies power autonomous vehicle data centers, AI factories, and cloud gaming services like GeForce Now[2][7]. Financially, Nvidia achieved record full-year revenue of $130.5 billion in fiscal 2025, with a workforce of over 36,000 employees worldwide and a robust patent portfolio exceeding 8,700 applications[2]. The company is recognized for innovation and workplace excellence, topping Forbes’ "America’s Best Companies 2025" and Fast Company’s "World’s Most Innovative Companies"

Intel

Intel Corporation is a leading American multinational technology company specializing in the design and manufacture of advanced semiconductors that power computing devices globally. Founded in 1968, Intel pioneered the development of microprocessors, becoming the dominant supplier of x86-based processors for PCs, servers, and other computing platforms. The company is known for its continuous innovation in semiconductor technology and its role in shaping the modern computing landscape. Intel's recent technological advancements include the launch of the Intel® Core™ Ultra series 3 processors (code-named Panther Lake) and Intel® Xeon® 6+ processors (Clearwater Forest), both built on the cutting-edge Intel 18A semiconductor node—currently the most advanced manufacturing node in the United States. These products are manufactured at Intel’s state-of-the-art Fab 52 facility in Chandler, Arizona, showcasing Intel's commitment to domestic production and technological leadership[1]. In the face of intense competition from rivals such as AMD and the architectural shifts exemplified by Apple’s move to its own silicon, Intel has been undergoing significant restructuring. This includes workforce reductions by approximately 15%, aiming to streamline operations, improve efficiency, and focus on core growth areas like AI and data centers. Financially, Intel reported solid demand and revenue resilience, with Q2 2025 revenue reaching $12.9 billion, exceeding guidance despite challenges from one-time costs and impairments[3][5]. The company is also enhancing its foundry business and AI roadmap to strengthen its competitive position and long-term shareholder value[3]. Intel’s strategic partnerships, including a $5 billion investment by Nvidia to jointly develop CPUs, and talks of adding AMD as a foundry customer, highlight its adaptive approach to industry dynamics[6]. Despite recent challenges and market shifts, Intel remains a crucial player in the semiconductor industry, advancing AI-enabled platforms and maintaining a significant impact on the global technology ecosystem[1][6].