Fed Signals FOMC Shift: Rate Cut and Policy Outlook

#federal_reserve #fomc #monetary_policy #economy #interest_rates

Federal Reserve Issues Latest FOMC Statement

The Federal Reserve's recent Federal Open Market Committee (FOMC) statement highlights that economic activity continues to expand at a moderate pace. Despite this growth, job gains have slowed in 2025, and the unemployment rate has seen a slight increase. This signals a cautious labor market environment amid ongoing economic shifts.

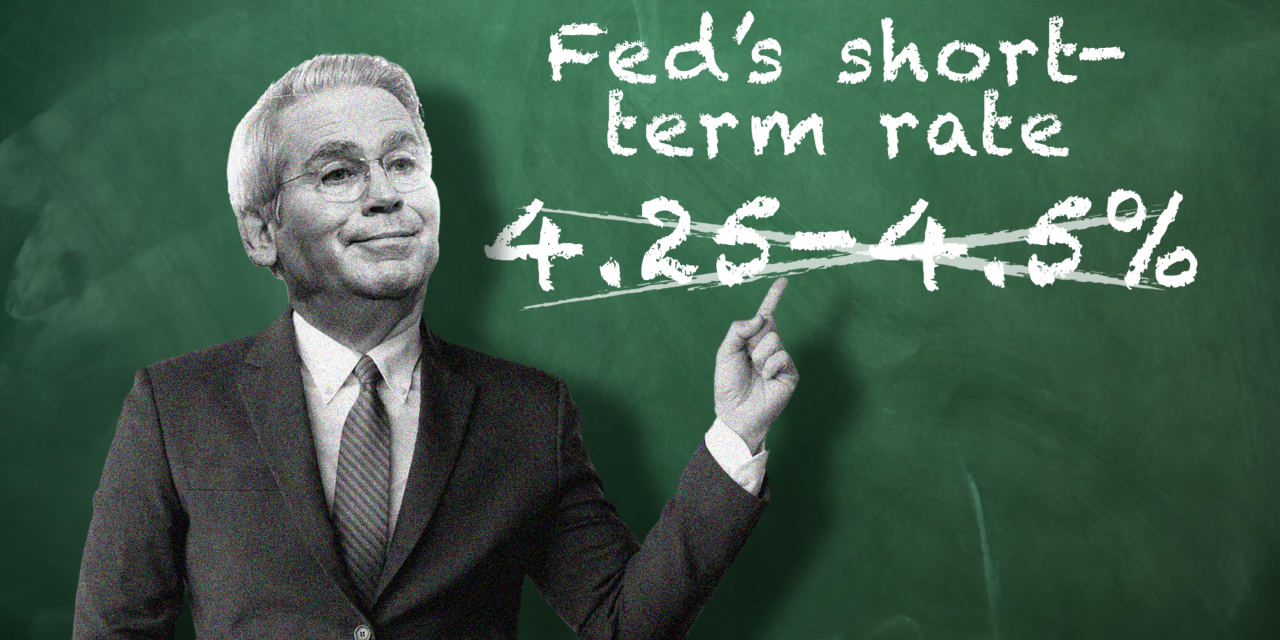

Monetary Policy Adjustments

In response to evolving economic conditions, the Federal Reserve unanimously approved a quarter-percentage-point reduction in the primary credit rate to 3.75%, effective December 11, 2025. This decision aims to support the dual mandate of maximum employment and inflation near 2 percent over the longer term. The committee also directed open market operations to maintain the federal funds rate within the target range of 3.5% to 3.75%, reflecting a careful balance between fostering growth and controlling inflation.

Economic Outlook and Risks

Uncertainty about the economic outlook remains elevated, with risks to employment skewed to the downside and inflation risks tilted upward in the near term. The Fed’s measured actions indicate attentiveness to these risks, aiming to stabilize the labor market while keeping inflation expectations anchored.

About the Organizations Mentioned

Federal Reserve

## Overview and Mission The Federal Reserve, often called the "Fed," is the central bank of the United States, established by Congress in 1913 to provide the nation with a safer, more flexible, and stable monetary and financial system[1]. Its mission centers on a dual mandate from Congress: to promote maximum employment and maintain price stability, ensuring the dollar retains its value over time[1]. The Fed operates through a unique hybrid structure, combining a national Board of Governors in Washington, D.C., with 12 independent regional Reserve Banks, including institutions like the Cleveland Fed[1]. This decentralized setup allows the Fed to closely monitor economic conditions across diverse regions, industries, and communities, while maintaining independence from short-term political influences[1]. ## Key Functions The Fed’s responsibilities are broad and vital to the U.S. economy. It conducts monetary policy—primarily by influencing interest rates—to achieve its employment and inflation goals[2]. The Fed also supervises and regulates banks to ensure the safety and soundness of the financial system, works to minimize systemic risks, and fosters efficient payment and settlement systems[2]. Additionally, it promotes consumer protection and community development, addressing emerging issues through research, supervision, and enforcement of consumer laws[2]. ## History and Evolution The Federal Reserve is the third central bank in U.S. history, following two failed attempts in the 19th century[1]. Its creation was a response to the financial turbulence of the early 20th century, aiming to prevent crises and stabilize the economy. Over time, the Fed has evolved, adopting more transparent and inclusive policymaking processes. For example, it now conducts regular reviews of its monetary policy framework, engaging with academics, businesses, and the public to refine its strategies and communications[3][5]. ## Recent Developments and Achievements In 2025, the Fed completed its second major review of its monetary policy strategy, tools, and communications, reaffirming its commitment to transparenc

Federal Open Market Committee (FOMC)

The **Federal Open Market Committee (FOMC)** is the central body within the U.S. Federal Reserve System responsible for formulating and directing national monetary policy. Established by legislation in 1933 and 1935 as part of the Federal Reserve reforms, the FOMC was created to centralize and coordinate open market operations, which involve buying and selling government securities to influence liquidity and interest rates in the economy[1]. The FOMC's primary role is to set the "stance" of U.S. monetary policy to achieve the dual congressional mandates of **maximum employment** and **price stability**. It does so primarily by determining the target range for the federal funds rate—the interest rate at which banks lend to each other overnight—and directing open market operations that influence this rate and the overall money supply. These monetary policy tools shape credit availability and the cost of borrowing, thereby affecting economic growth, employment, inflation, and long-term interest rates[1][2][4]. The Committee consists of twelve members: the seven Board of Governors members, the president of the Federal Reserve Bank of New York, and four rotating presidents of other Federal Reserve Banks. This structure ensures a blend of national oversight and regional perspectives. The FOMC typically holds eight scheduled meetings annually, reviewing economic and financial conditions and adjusting policy to respond to evolving risks and opportunities[2][3][6]. Historically, the FOMC evolved from earlier coordination efforts among the twelve Federal Reserve Banks, formalized in the 1930s to enhance effectiveness and transparency. Notably, the FOMC’s implementation of monetary policy has adapted over time—from managing scarce reserves pre-2008 crisis to using new tools like the Overnight Reverse Repurchase Agreement (ON RRP) facility introduced in 2014 to help control interest rates[1][4]. The FOMC’s decisions are closely watched by investors, businesses, and policymakers worldwide due to their broad impact on financial markets and the economy. Its announcements often drive