Mixed Markets and Uncertainty: The Potential Impact of a Federal Reserve Interest Rate Cut

#asia-pacific markets #interest rate cut #economy #market analysis #federal reserve

Introduction

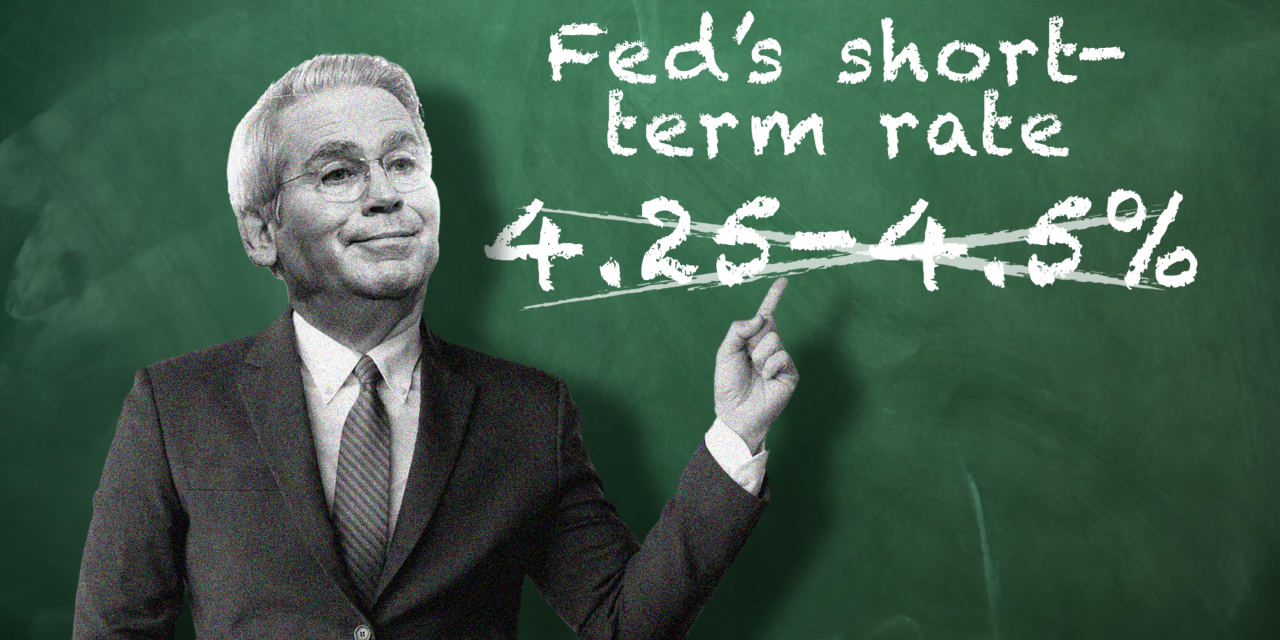

Investors in Asia-Pacific markets closed mixed as they placed bets on a potential interest rate cut by the Federal Reserve. This follows news that Australia's unemployment rate has eased to 4.2% on a seasonally-adjusted basis in July. This is in line with estimates from economists polled by Reuters. The market remains uncertain about the potential rate cut decision and its impact on the global economy.

Market Analysis

The mixed market closing reflects the uncertainty surrounding the potential rate cut decision. Some investors view it as a positive move that can stimulate economic growth, while others are concerned about the potential risks and consequences. The easing unemployment rate in Australia also adds to the uncertainty, as it may indicate a strong economy that does not require a rate cut. The market is closely monitoring the situation and its impact on various sectors, such as banking and technology.

Possible Outcomes

The decision of the Federal Reserve on the interest rate cut can have significant implications not only on the Asia-Pacific markets, but also on the global economy. If the rate cut is implemented, it can potentially boost economic growth and stock markets. However, there are also concerns about the potential impact on inflation and the stability of the financial sector. The mixed market closing reflects the cautious and uncertain sentiment among investors as they await the decision of the Federal Reserve.

About the Organizations Mentioned

Federal Reserve

## Overview and Mission The Federal Reserve, often called the "Fed," is the central bank of the United States, established by Congress in 1913 to provide the nation with a safer, more flexible, and stable monetary and financial system[1]. Its mission centers on a dual mandate from Congress: to promote maximum employment and maintain price stability, ensuring the dollar retains its value over time[1]. The Fed operates through a unique hybrid structure, combining a national Board of Governors in Washington, D.C., with 12 independent regional Reserve Banks, including institutions like the Cleveland Fed[1]. This decentralized setup allows the Fed to closely monitor economic conditions across diverse regions, industries, and communities, while maintaining independence from short-term political influences[1]. ## Key Functions The Fed’s responsibilities are broad and vital to the U.S. economy. It conducts monetary policy—primarily by influencing interest rates—to achieve its employment and inflation goals[2]. The Fed also supervises and regulates banks to ensure the safety and soundness of the financial system, works to minimize systemic risks, and fosters efficient payment and settlement systems[2]. Additionally, it promotes consumer protection and community development, addressing emerging issues through research, supervision, and enforcement of consumer laws[2]. ## History and Evolution The Federal Reserve is the third central bank in U.S. history, following two failed attempts in the 19th century[1]. Its creation was a response to the financial turbulence of the early 20th century, aiming to prevent crises and stabilize the economy. Over time, the Fed has evolved, adopting more transparent and inclusive policymaking processes. For example, it now conducts regular reviews of its monetary policy framework, engaging with academics, businesses, and the public to refine its strategies and communications[3][5]. ## Recent Developments and Achievements In 2025, the Fed completed its second major review of its monetary policy strategy, tools, and communications, reaffirming its commitment to transparenc

Reuters

**Reuters** is a leading global news agency founded in 1851 by Paul Julius Reuter, a German immigrant who innovatively combined telegraphy and carrier pigeons to transmit financial and news information rapidly between cities like London and Paris[1][2][4]. Starting from a modest office in London’s financial district, Reuters quickly gained a reputation for speed, accuracy, and impartiality, exemplified by its early scoop on the death of U.S. President Abraham Lincoln in 1865, beating competitors by hours[1][2]. Historically, Reuters evolved from a commercial news service focused on stock prices for banks and brokerage houses to a comprehensive international newswire serving newspapers worldwide. Its expansion reflected the growing importance of timely, reliable news in business and global affairs[2][3]. The company’s independence and editorial integrity have been safeguarded since 1947 by the Reuters Trust Principles, which commit Reuters to unbiased and accurate reporting[4]. Today, Reuters operates as part of Thomson Reuters, a Canadian multinational headquartered in Toronto. It is recognized as the largest global news agency, with over 2,600 journalists in 165 countries producing around 2 million unique news stories annually in 12 languages[5]. Reuters embraces cutting-edge technology to deliver breaking news, multimedia, and authenticated content to media, technology firms, governments, and corporations, ensuring fast and seamless distribution[5]. Notable achievements include winning over 300 journalism awards in the last decade, such as the 2024 Pulitzer Prizes for National Reporting and Breaking News Photography, and the George Polk Award for Business Reporting, underscoring its leadership in business and technology journalism[5]. Reuters continues to innovate, recently unveiling AI tools to enhance video production and engagement, reflecting its commitment to shaping the future of news in a digital age[5].