Tricolor Executives Charged in Alleged Systematic Subprime Fraud

Tricolor executives charged after alleged systematic fraud

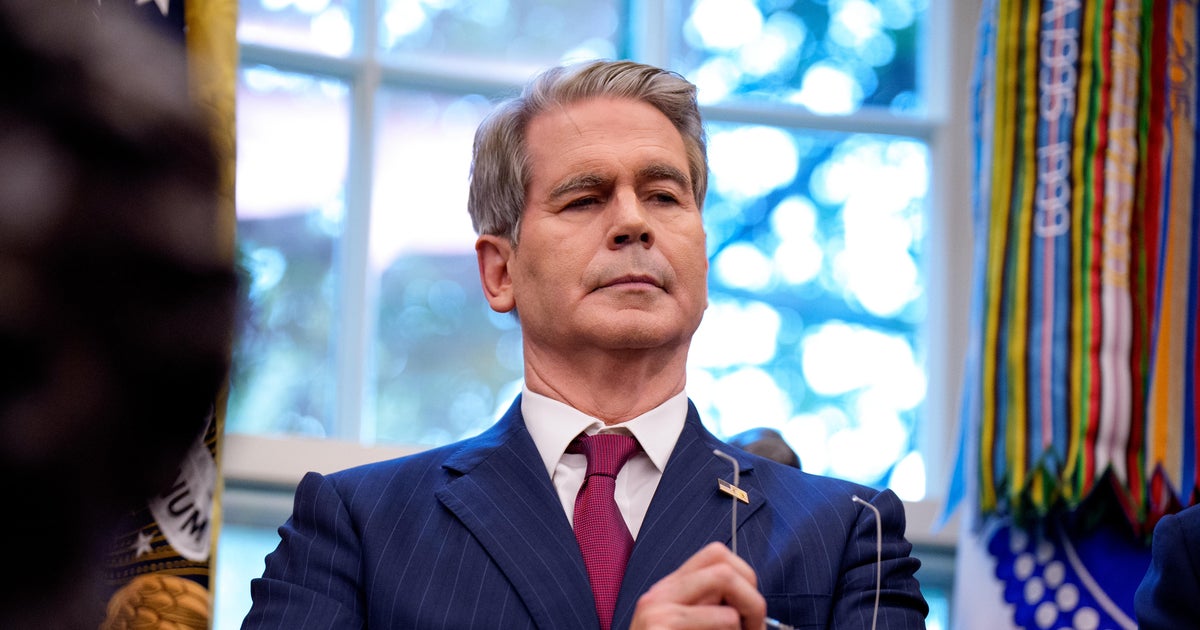

Federal prosecutors say senior managers at Tricolor orchestrated schemes that let the subprime auto lender obtain billions by misrepresenting collateral and loan performance, triggering criminal charges including bank fraud and conspiracy against top executives, according to recently unsealed indictments.

Allegations, evidence and wider impact

The indictment alleges practices such as double‑pledging the same loan collateral to multiple lenders, fabricating payment records and altering loan dates to disguise delinquency, actions that left large banks with multi‑hundred‑million dollar hits and lenders reassessing credit controls; two former executives have pleaded guilty and are cooperating with investigators while prosecutors pursue additional charges and asset recoveries.

Why it matters for markets and borrowers

The case highlights risks in buy‑here, pay‑here and subprime lending, prompting calls for tighter oversight, greater transparency from commercial borrowers and potential changes in how banks verify collateral to protect investors and vulnerable consumers.

About the Organizations Mentioned

Tricolor

Tricolor is a U.S.-based subprime auto retailer and lender that built a vertically integrated model combining used-car dealerships with in-house financing for underbanked borrowers, then collapsed amid allegations of extensive fraud in 2025. Tricolor’s business aimed to serve customers with little-or-no credit by selling reconditioned vehicles and originating credit-building loans, using advanced data analytics and bilingual sales at regional locations to reach largely Hispanic and other underbanked communities[3]. Founded in Dallas in 2007, Tricolor expanded into multiple dealerships and created captive financing vehicles to fund originations; by the 2010s it was a notable player in the nonprime auto market and issued large volumes of asset‑backed securities secured by auto loans[2][5]. Its growth strategy combined dealership operations, loan origination, and securitization to access warehouse lines and capital markets funding[5]. Key achievements before its collapse included rapid expansion of retail locations and securitization activity that allowed substantial loan origination volumes, which garnered attention from fixed‑income investors and lenders[3][5]. However, in 2025 the company unraveled: lenders pulled credit lines amid rising charge-offs and fraud concerns, employees were placed on leave, and Tricolor filed for Chapter 7 liquidation in September 2025, leaving borrowers and creditors exposed[4][2]. Investigations by federal prosecutors followed, with criminal charges announced against senior executives alleging schemes such as double‑pledging loan portfolios and other fraudulent conduct that misled lenders and investors[6][4]. Current status (as of late 2025): Tricolor entered liquidation under Chapter 7, federal investigations and criminal prosecutions of top officers were underway, and major institutional creditors reported material losses tied to Tricolor’s asset‑backed securities[2][6][5]. The company’s collapse has become a cautionary case in auto‑